ARENA has released their public summary of the Request For Information (RFI) on Concentrated Solar Thermal (CST) projects. The RFI process was designed to examine the potential for a possible program supporting the deployment of CST systems in Australia. There were 31 respondents to the RFI. Respondents ranged from the most experienced in the world to relatively junior Australian companies. There were a couple of key takeaways from the exercise which included:

– That dispatchable and flexible generation coupled with synchronous generation was beneficial;

– Cost discovery was limited as pricing is commercially sensitive in nature. More junior developers offered low pricing;

– There are a number of regulatory, commercial and technical challenges to CST.

– Long development time relative to solar PV

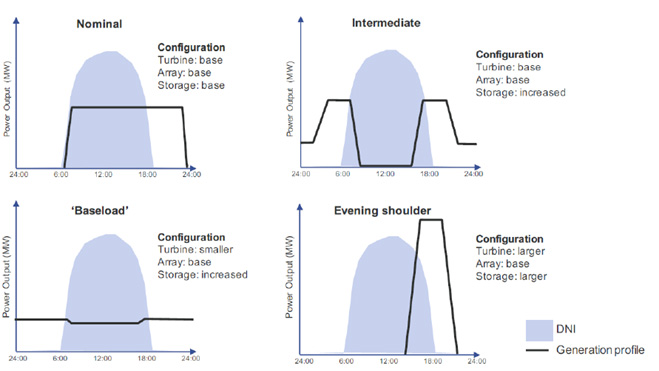

Image 1 comes from Vast Solar and was included in the ARENA report. The image provides a summary of the generation capability of a CST. Noting that the profile is a function of the physical design.

Image 1. CST potential generation profile

The information collected on pricing was limited however, ARENA did provide a Levelised Cost of Electricity (LCOE) estimate based on 12 of the respondents RFI’s. The lower estimate was $124.00/MWh and upper was $154.00/MWh. These numbers are significantly above the reported price of $78.00/MWh that the SA Government is paying for generation from the Port Augusta CST plant (noting there is a significantly discounted loan attached to that project).

Concentrated Solar Thermal and the National Energy Guarantee?

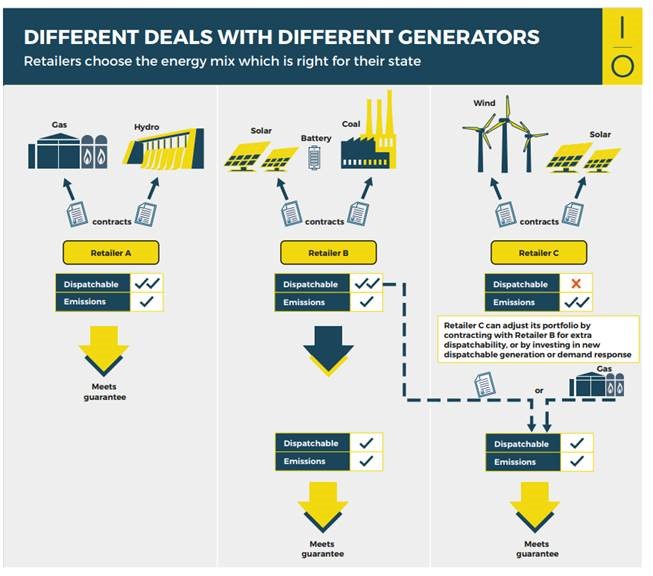

At a high-level CST appears to be the golden egg of generation assets if the NEG is implemented. The assets are renewable and dispatchable which positions itself to be able to write dispatchable and low emissions contracts (Image 2.). The question is will the incentives under the NEG be sufficient to warrant the price and risks associated with CST. Currently, the answer seems to be no. The answer is no because of the considerable uncertainty around how the NEG will function and the developers ability to forecast income.

The timeline for the NEG is tight, when asked earlier in the week the ESB Chair Kerry Schott referred to the time frame as “tight but doable”, an underwhelming response. Vague language of this nature does not signal confidence to the investment community nor the consumer. In addition to this, the Federal opposition has been quiet on where they stand in respect to the NEG. In the near term, we are unlikely to see investment in large-scale CST until further clarity is provided on the NEG.

Image 2.

Edge maintains strong relationships with developers of CST plants. If you are interested in understanding more, please get in contact with us. For further information on the National Energy Guarantee please follow the link to our recent submission.

If you would like to know more about energy costs and state-based subsidy, please get in contact with Edge on (07) 3905 9220 or 1800 334 336.