Edge Insights provides you with the latest news in the energy industry and showcases some of our services that help to ensure businesses maintain their optimal energy arrangements at all times. In this edition:

- Large Scale Solar Conference

- Procuring Your Energy

- Staff Profile: Kristy McGrath

- State of the Market: Q117 electricity prices overview

- AEMO releases Gas statement of opportunity

- Join ‘Team Jess’ & save lives

Large Scale Solar Conference – Sydney

|

The competitive round for large-scale solar photovoltaics held by ARENA saw enough successful projects to triple existing production of large-scale solar in Australia. Edge is proud to have assisted with several of these projects to bring them to financial close. The large-scale solar technology is also a developing technology. To stay on top of the market and to discuss future challenges, we attended the recent Large Scale Solar Conference hosted by Informa in Sydney. The conference was well attended with representation from State Governments, ARENA, Clean Energy Finance Corporation, as well as new and existing developers and research institutions. Large-scale solar has come a long way from being a collection of fixed plates at the fringe of the market (both literally and figuratively). It is now becoming a highly integrated and bankable technology. The cost of large-scale solar is now equivalent to wind in many regions and continued innovation is bringing the cost down even further. |

There is further development in the integration of large-scale solar including mix use with wind and batteries, and installation with pump storage hydros to provide baseload technology. There is also an opportunity in further innovation for investment in renewable generation. With financing costs being the most significant project consideration involved with large-scale solar, getting the right financing structure is critical. The most important lesson learned was early and genuine engagement will get a better result. This means engagement with community, Large Scale Solar Conference – Sydney land holders, transmission service providers, and consumers. Without genuine engagement, a project will rarely be successful. Large-scale solar is now cost competitive with other technologies and with more innovation and improvements to come, it is one of the technologies of the future. The conference was packed with useful presentations and perspectives. If you want to hear more about large-scale renewable energy, please contact us on 07 3232 1115. |

PROCURING YOUR ENERGY

ACHIEVING LOWER COSTS & MITIGATING RISKS

|

Recent events show the National Electricity Market (NEM) is changing and becoming more volatile. Electricity prices have risen significantly and the market presents risks for consumers when it comes to managing their electricity supply and spend. At Edge, we develop tailored procurement strategies to achieve lower costs and mitigate risks for our customers. These strategies may include one or more of the following options. Fixed Price, Fixed Term The traditional way of purchasing electricity is to agree rates for peak/offpeak usage with a retailer for a defined term. The term would typically be for a year or two, but could be as short as a quarter or as long as five years. This contract type is easy to manage and provides a known energy rate for the duration of the contract. All price uncertainty is worn by the retailer. Pool price exposure This pricing arrangement involves taking on exposure to the variable electricity spot price (pool price) which varies for each 30-minute period. Pool exposure may involve part or whole load exposure to spot prices. Generally, spot price exposure is recommended for loads that can respond to pricing changes. (Curtail usage during high prices and operate during low prices). Spot price exposure comes with a considerable increase in risk, and variability in cash flows. For consumers who cannot hedge spot prices physically, we would only recommend incorporating spot exposure if done so in conjunction with a component of fixed pricing.

|

Hedging All customer connection points settle in the market against the pool price. This pool price exposure can be hedged using relatively standard electricity derivative contracts. Any mismatch between hedged quantities and actual load shape will result in pool exposure either through over-hedging (contracts greater than load in which case exposure is too low to pool prices) or under hedging (contracts less than load in which case exposure is too high to pool prices). Progressive purchasing Progressively agreeing fixed prices (as opposed to one price) is a method of diversifying timing (market) risk. This type of purchasing involves locking in a price for part of the electricity load in advance in incremental stages. It provides the benefit of improved price risk management and the flexibility to lock in prices quickly. Generally, the minimum energy block that retailers will allow progressive purchasing is 1MW though some retailers have started to offer this product in lower increments. Progressive pricing is most commonly conducted on a quarterly or calendar year basis. What approach works for you? There are many combinations of the above options that are possible, all of which will have differing risk profiles and price premiums. We can implement a strategy that includes one or more of these options that has been tailored to your energy portfolio by conducting a thorough analysis of your demand, usage and business drivers. Let us show you how we can bring your electricity costs down. |

STAFF PROFILEKristy McGrath What is the best piece of advice you have ever received? Find success in your failures. Name a place you have never been to and would like to visit. Why? The Bungle Bungles in Western Australia. The mystery and myths behind this place would make it an exciting place to visit. Who or What inspires you? My parents. They both worked hard to give us everything we needed to be happy and healthy. Their physical and mental determination provided excellent childhood memories and solid foundations for me to build on. What is one of the biggest challenges facing energy customers today? The energy industry is changing and announcements in the market can have a significant impact on the cost of electricity. Keeping up with the industry can be time consuming and requires expertise and constant monitoring. Often, the people responsible for managing business energy costs are time-poor and manage multiple utilities. We help these customers by making sense of the market and providing tailored advice for their portfolio. What does a typical day look like for you at Edge? I review client deliverables and work with the team to ensure they’re delivered on time. This could mean reviewing client reports, agreements or papers. I also manage the operations of the business. This includes negotiating contractual agreements through to auditing internal risk controls under our Quality Management System. |

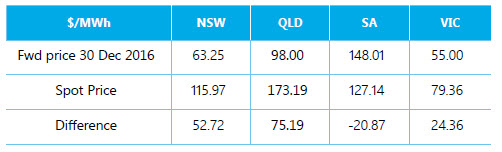

STATE OF THE MARKET

|

AEMO RELEASES GAS STATEMENT OF OPPORTUNITIES

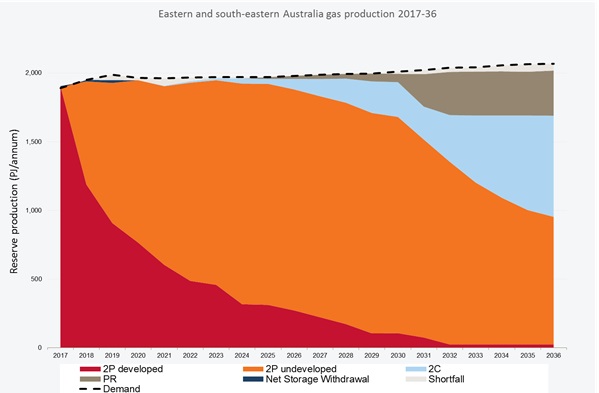

Gas supply and security of electricity supply have been hot topics in the industry and the political and media space this quarter. This was explored in the recent annual statement of gas opportunities published by the Australian Energy Market Operator (AEMO). The report focuses on planning across the energy supply chain and the interdependencies of gas and electricity

|

Key points in AEMO’s gas statement include;

|

RESPONSE TO GAS SUPPLY ISSUES There was a concern that a shortfall in supply could cause issues with supplying industrial consumers or the supply of gas for electricity generation to meet peak demand. The Prime Minister recently sought assurances from gas producers that the shortfall would not transpire. Gas producers agreed to make more gas available to the domestic market “as soon as possible”. Victoria and the Northern Territory currently have moratoriums on both on-shore conventional and unconventional gas exploration. In addition, New South Wales’ buy-back of a significant number of the State’s Petroleum Exploration Licences has put a stop to any possibility of new gas developments in the State. Bucking the trend, Queensland continues to support on-shore gas exploration for both supply to the liquefied natural gas (LNG) export industry and the east coast market. News has also emerged that Origin Energy and Engie have struck a gas supply deal in South Australia. Origin will supply gas to Engie’s Pelican Point Power Station for three years providing 240MW of electricity in South Australia. CUSTOMER’S FEELING THE PAIN Customers coming off retail gas supply agreements are certainly feeling the pain of a market experiencing tight supply. AGL confirmed in early March that AGL is out of contracted gas and may be required to supply customers from the spot market. AGL has been quoting $20/GJ for gas for customers in NSW in 2017 and beyond, with some customer’s experiencing a trebling of their previous contract gas prices. In the east-coast gas market, gas retailers are limited and in some instances, appear to be pricing uncompetitively. Customers who are yet to secure gas contracts in 2017/2018 should explore all options open to them

|

JOIN ‘TEAM JESS’ AND SAVE LIVES

We’d like to introduce you to Jessica. Jess has a rare immune deficiency, which means her immune system doesn’t work as it should. Her body can’t respond to infection and she can get sick very easily. To keep her healthy, Jess requires treatment with a blood product called Intragram every four weeks. This life-saving infusion means Jess is no longer sick all the time and it allows her to do all the fun things she loves. It wouldn’t be possible without blood donations.

To raise awareness of the importance of blood donation, Jess’s family has JOIN ‘TEAM JESS’ AND SAVE LIVES created ‘Team Jess’, a Red 25 group that is part of the Australian Red Cross Blood Service’s Group Blood Donation program. Jess’s family would like to encourage everyone who is able to donate blood, to join ‘Team Jess’ and help them achieve their goal. Blood donations can be made at any Australian Red Cross Blood Service Donor Centre or Mobile Donor Van in Australia. donateblood.com.au.

Did you know that only 1 in 30 people donate blood, but 1 in 3 will need it in their lifetime?

Full PDF edition: Edge Insights – Issue 3