Domestic gas prices on the east coast of Australia have been through a huge transitional period as a result of the introduction of the LNG export market from Curtis Island. Whilst there have been a broad range of changes, one of the key factors increasingly influencing price that domestic consumers pay is the price of oil. Domestic contracts are now being offered at oil linked pricing which effectively means that if the price of oil increases so will the price of your gas (and vice versa). For large gas producers this is nothing new as hedging commodity prices is part of their core business. For consumers however this may be more challenging depending on the products they produce.

Other factors that are now impacting Australian gas prices are:

- Climate change policies in Asia as gas is a widely used fuel for clean electricity generation. This is particularly important when considering China due the huge demand and current reliance on coal generation.

- Manufacturing levels in Japan

- US production levels and construction of pipelines

- Renewable energy technology developments

Turning our attention to domestic gas influences the Northern Territory Chief Minister Michael Gunner has recently announced that the 135 recommendations made in the recent inquiry into fracking in the NT would be implemented, allowing on-shore fracking to take place in the territory. The 135 recommendations made in the inquiry mitigate the risks associated with onshore gas development to acceptable levels, and in some cases claim to eliminate the risks completely. New gas developments will require environmental management plans which will be assessed by the NT Environment Protection Authority and signed off by the environment minister. There will also be area’s where fracking will not be allowed. These include indigenous protected areas, special environmental areas, cultural and agricultural areas of significance to the Northern Territory. There is a number of studies to be completed before fracking production can begin including strategic environmental and baseline assessments. At this stage it is estimated that exploration will begin in 2019 and production in 2021.

On 21 May Santos Rejected Harbour Energy’s (Harbour) offer to purchase 100% of shares at US$5.21 per share. In an effort to get the deal over the line Harbour offered $5.25 per share if Santos was willing to extend certain oil price hedging arrangements. The final offer from Harbour had a number of conditions which included Santos assisting with debt raising and hedging a significant portion of Santos oil-linked products as well as FIRB approval. Once the offer was rejected Santos shared its view on how superior shareholder value could be realised through executing the current strategy.

Australian Industrial Energy will see Port Kembla in NSW developed into an LNG import terminal. The Andrew Forest venture recently reached significant milestones. These include receiving backing from Japanese energy giant JERA and signing a memorandum of understanding with 12 potential customers (according the AFR). Project development is still subject to approvals.

AEMO recently released its Victoria Gas planning report update that painted a concerning outlook in respect of depletion of offshore gas fields reserves. The data provided to AEMO from producers in the Gippsland basin forecast production to reduce to 38% below the 2018 production forecast and 68% for Port Campbell. In response to this outlook gas producers and other market participants are investigating additional supply and capacity.

Regional analysis

Narrowing our focus, Edge take a closer look at gas generation in each region and the local gas trading hub. As we know the Federal Government threatened LNG producers with the Australian Domestic Gas Mechanism late last year if they didn’t allocate more gas to domestic consumers. The threat appeared to have worked with each of the LNG producers advocating that they had made gas available.

When we take a closer look at whether a relationship exists between gas generation and gas hub prices we realise that it is difficult to discern. Limitations in access to pipeline capacity, contractual arrangements and sophistication of users are potentially key drivers behind this.

The following graphs display average gas generation from 1 January 2017 to the end of May 2018 on a regional basis as well as the average gas price for the same period.

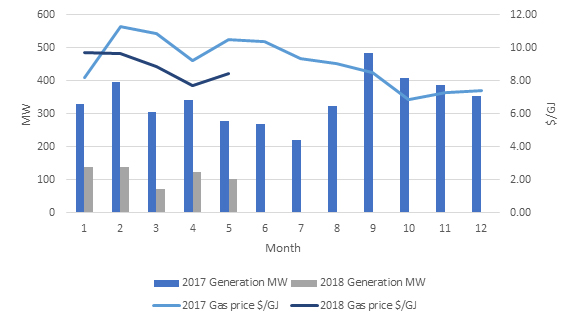

Queensland

From the graph we can observe that gas generation in 2018 (to date) is largely in-line with 2017. The consistent level of generation is interesting given the significant decline in spot electricity prices in Q118 relative to that of Q117. On face value the lower spot prices in 2018 would result in less generation from gas power stations. What changed however between Q117 and Q118 was SwanBank E power station returned. The gas combined cycle power station ran consistently throughout Q118 averaging 237 MW of generation. Lower spot prices in the Brisbane STTM are a driven by lower demand and potentially increased supply as a result of the LNG producing increasing availability of gas to domestic consumers.

From the graph we can observe that gas generation in 2018 (to date) is largely in-line with 2017. The consistent level of generation is interesting given the significant decline in spot electricity prices in Q118 relative to that of Q117. On face value the lower spot prices in 2018 would result in less generation from gas power stations. What changed however between Q117 and Q118 was SwanBank E power station returned. The gas combined cycle power station ran consistently throughout Q118 averaging 237 MW of generation. Lower spot prices in the Brisbane STTM are a driven by lower demand and potentially increased supply as a result of the LNG producing increasing availability of gas to domestic consumers.

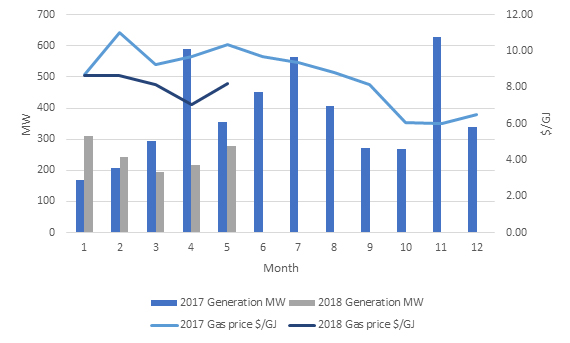

New South Wales

NSW gas generation was significantly down for the first 5 months of 2018 relative to the same period in 2017. Lower gas generation in NSW was largely the result of less volatility in the electricity spot market. If we look at the bid stacks of the large gas power stations in NSW, Tallawarra was the most motivated to produce energy offering up to 210 MW at below zero dollars. This strategy could not be observed at Uranquinty or Colongra.

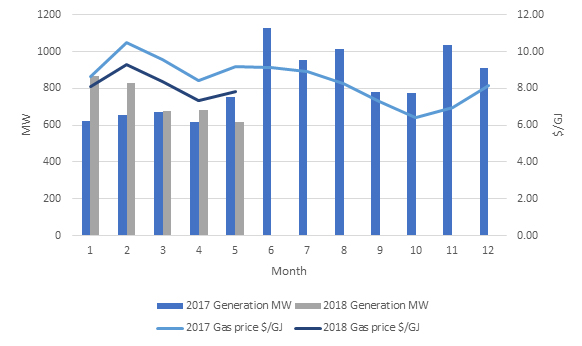

Victoria

Unlike NSW and QLD generation from gas powered power stations increased in January and February 2018 relative to the same months in 2017. The closure of Hazelwood power station in late March 2017 meant that the 1,225 MW (average generation of Hazelwood in Q117) was no longer available. Less baseload generation in the region resulted in higher electricity prices which meant that gas power stations were dispatched more regularly. Despite the increases in generation there was a decline in VIC gas market prices.

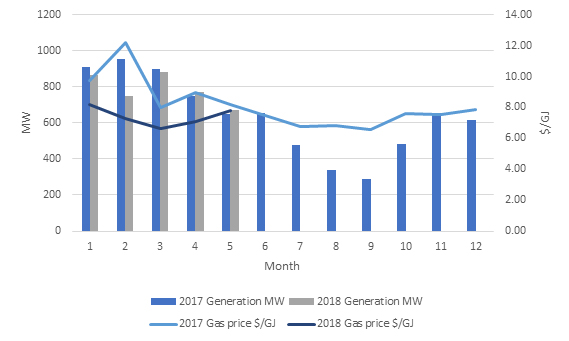

South Australia

Gas generation in SA has been heavily impacted by the increased level of intervention in the SA market by the market operator. The market operator has been constraining off wind generation and calling on gas generation which has increased overall generation from gas plant. This increased generation however has not translated into higher gas prices as we can see from the graph these 2018 prices are trending below 2017 prices.

When observing each of the regions and the time periods selected it is fair to say that generation from gas fired power stations and spot prices in the gas hubs do not drive average price outcomes.

If you would like to know more about what is happening in the gas market and how your business may be affected, please call Edge on 07 3905 9220 or contact your Edge Portfolio Manager.