Domestic gas prices have increased again as Queensland continues to export most domestic gas overseas in the form of Liquefied Natural Gas (LNG). Outages in early 2018 had limited output from the LNG facilities, however all trains are now available.

The increase in total gas extracted on the East Coast of Australia is the largest contributor to the increase in gas prices. Before LNG demand, domestic gas could be extracted from cheap resources. However, as more gas is extracted from Roma, Queensland, the price of extraction has increased, which is then passed onto consumers. With the ability to sell gas overseas, producers are also looking to obtain a similar price domestically when the cost of transport has been taken into account (so called netback prices).

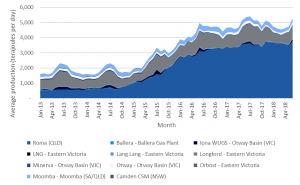

The Australian Energy Regulator (AER) has published the average daily production of gas by production point. This shows the large increase, particularly for Roma. The volume is necessary to justify the very high fixed costs of liquefying and exporting gas.

Source: AER

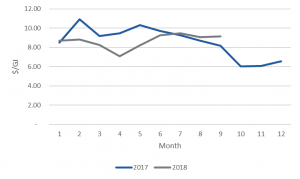

Overall, prices were lower at the start of 2018 and the Federal Government has been quick to point to its domestic gas policy, whereby producers could be forced to sell gas to domestic consumers ahead of exporting it in the event of a shortage. The inference is that without the domestic gas policy, prices would have been higher. A more obvious driver would be lower export of LNG as one of the export facilities was undergoing planned maintenance. With all facilities now back online, the prices have crept back up and are now higher than the same period in 2017 for all regions.

The Australian Labor Party (ALP) announced that it would look to further strengthen the domestic gas policy by forcing producers to sell locally before exporting if prices were too high. This goes beyond the current policy which requires a shortage for the gas policy to apply. The ALP has not indicated what they consider to be “high prices” for the policy to apply. Additionally, producers are concerned about uncertainty at a time when the gas market needs further investment. The current state of the electricity market should serve as a warning of what happens when there is little investment certainty.

Regional analysis

There are regional differences in the gas prices, which are mainly based on the different usage of gas. In Queensland, gas is mainly used for LNG export while in Victoria it is predominantly used by residential and commercial customers, particularly for heating. In South Australia and Tasmania, gas is still mainly used for gas powered generation (GPG).

Gas usage in 2017 by sector and region

| Residential / commercial | Industrial | GPG | LNG | Regional gas consumption (PJ) | |

| Queensland | <1% | 8% | 3% | 89% | 1,377 |

| New South Wales | 37% | 42% | 21% | 0% | 130 |

| South Australia | 11% | 23% | 66% | 0% | 101 |

| Tasmania | 5% | 33% | 62% | 0% | 15 |

| Victoria | 55% | 30% | 15% | 0% | 228 |

| Total | 10% | 14% | 10% | 66% | 1,851 |

Source: AEMO

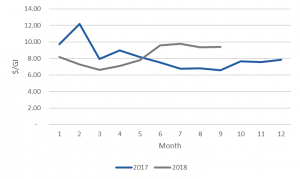

Queensland

With lower exports in early 2018, gas prices at the Brisbane hub have been lower than the previous year. Once the outage at an LNG facility was completed in June, prices went back to their elevated levels and have subsequently been sitting above the 2017 prices. In the short term, there is limited opportunity for production of gas to stop, which means that shut downs of facilities will tend to lower prices.

Since the increased LNG production, prices in Queensland have remained steady, consistent with prices in 2017 before the shutdown. There is little gas used outside of LNG in Queensland, therefore making it the main driver.

New South Wales

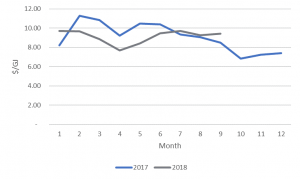

Gas is primarily used in industrial process in New South Wales, providing a flat demand across the year.

From the above graph, it is apparent that prices have been stable across most months. There were slightly lower prices until approximately June 2018 as cheaper gas flowed from Queensland. Prices have started trending up since then.

South Australia

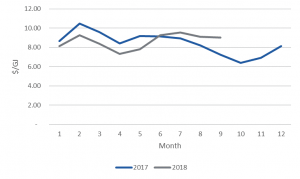

Gas in South Australia is predominately used by gas powered generators. These tend to operate more in both summer and winter when demand for electricity is generally higher.

South Australian gas prices have been modest throughout the year. Higher demand for gas generation in February increased prices overall, however the largest change was again in June when the Queensland LNG facility started exporting again after its outage.

There is still a large swing component of gas demand in South Australia due to residential/commercial demand. Even though this only represents 11% of overall consumption it tends to be very concentrated for a few days per year.

Tasmania / Victoria

There is no separate Tasmanian gas market with most contracts based on the Victorian prices.

Victoria also has the largest proportion of gas being used by residential/commercial consumers. This creates a large swing in gas demand throughout the day and throughout seasons. Unlike South Australia which uses a lot of gas for power generation, Victoria mainly relies on coal. This means that prices are typically lower in summer and higher in winter.

If you would like to know more about what is happening in the gas market and how your business may be affected, please call Edge on 07 3905 9220 or contact your Edge Portfolio Manager.