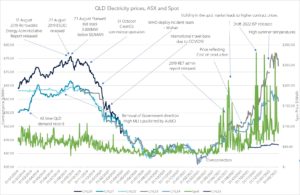

In the past 2 years, the market has dropped from highs of over $75/MWh in August 2019 then following the events outlined on the chart below the market price dropped to historic lows of around $36/MWh.

Following some volatility at the start of 2021 driven by a hot summer, the market firmed and increased further because of the catastrophic failure of Callide C4 and the tripping of many other power stations.

The chart below shows that the underlying spot price (light blue line) has continued to spike and trend up resulting in increases in the contract prices. Another interesting aspect of price curves is how market announcements such as the cost of coal and gas can impact the curve. In months, the curve softened but spiked due to conflicts in Ukraine causing coal and gas, a key input to thermal generation, to increase in price.

The spot price of these commodities is not directly linked to the fuel price used by generators in the next quarter, so the market has now softened.

Future years are also becoming cheaper year on year as renewable energy takes a larger share of the market and renewable energy is expected to continue to fall in price.

Having recently undertaken a few requests for proposals (RFP) for our clients, we are aware there is good value for companies willing to take up longer term renewable PPAs. More and more projects are becoming available post 2023/24.

Undertaking a renewable PPA will go towards meeting many companies’ sustainability targets through the procurement of renewable energy and environmental certificates.

Below are the contact details for Alex. He would be happy to discuss your company’s sustainability targets and how we can help the business reach them.

Alex Driscoll

Senior Manager Markets, Trading & Advisory

M: 0437 966 409

P: (07) 3905 9226

T: 1800 334 336