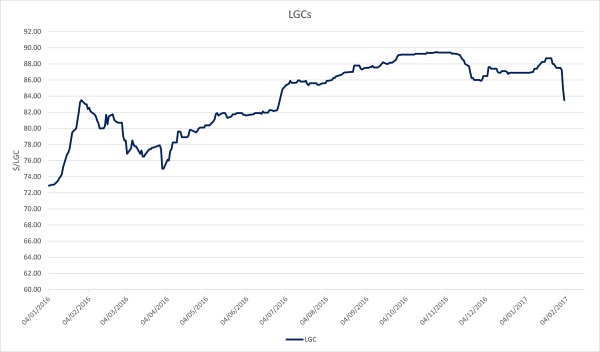

Yesterday we considered the possibility of large-scale generation certificate (LGCs) prices reducing due to the federal review. Prices have slid $4/certificate this week.

In recent news reports, ERM founder, Trevor St Baker said the government would need to adjust the renewable energy target (RET) to 20,000 gigawatt hours to fall in line with infrastructure expectations.

“There is no way we are going to make the 33,000 target. It’s impossible to get there.” Mr St Baker said.

We concur, and have for quite some time. Fundamentally, in a politically stable environment, we can only see LGC prices trending to and sitting at the full tax adjusted penalty of around $93/LGC. There aren’t enough certificates in the market to fulfil obligations without a sharp increase in the number of new renewable generation projects coming online over the next two years. We still forecast an LGC deficit during 2018.

However, we do not live in a politically stable environment. Abbott and Turnbull went head to head last week over the future of the RET. This combined with 2016 liabilities being squared away, has seen $4/certificate shaved off spot LGC prices this week. This is a reduction of approximately 5 percent. The movement shows how quickly environmental markets can change when politicians weigh-in.

After almost guaranteed price increases following the bipartisan agreement in 2015, trade for 2017 just got interesting.

LGC prices since 2016

References: http://www.afr.com/news/politics/renewables-target-will-not-be-met-says-erm-founder-20170126-gtyyvo

If you need to buy or sell LGCs and need advice on timing to market, please contact us here or on 07 3232 1115.