In this summer edition of the market update we look at some of the issues which is causing price differences in wholesale prices across the east coast of Australia. Since the start of summer, the divide has mainly been across the Murray river with QLD and NSW to the north and VIC, SA and TAS sitting to the South.

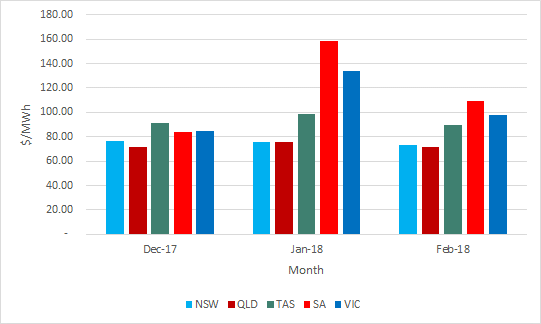

The summer started in December with modest spot prices across all the regions. The region with the highest price was TAS at $90.96/MWh with the lowest price being QLD at $76.56/MWh. The interconnectedness of the market means that prices in NSW was similar to QLD while SA and VIC were closer to TAS. The prices in NSW started deviating from the southern market as the interconnector with VIC became increasingly constrained. Throughout January there were large price spikes in SA and VIC increasing the average price south of the Murray. The constrained interconnector meant that the prices never travel north and both QLD and NSW had modest prices.

Tasmania had similar prices throughout the three months however these seem to be too high for the State Liberal Government. There is an election in Tasmania 3 March 2018 and one of the policies put forward by the State Liberal Government would be a split from the NEM. TAS would still be physically connected through Basslink however would not be subject to the price setting mechanism set out for the NEM. The State Liberal Party is expecting this to result in lower wholesale prices for TAS.

Prices for summer to date has been higher in SA than any other state however there haven’t been any black outs. This is in part due to the operation of a new 100 MW battery installed by Tesla which provides energy during peak times as well as support for frequency. With an election in SA 17 March 2018 the incumbent State Labor party made its own electricity policy announcement. It would seek to further partner with Tesla to install 50,000 rooftop solar panels and batteries. When combined this would create a virtual 250 MW power station.

The Energy Security Board (ESB) realised its Draft Design Consultation Paper on the National Energy Guarantee (NEG). The NEG seek to find a balance between affordability, reliability and carbon reduction which could be politically acceptable. With the number of schemes already rejected by the Federal Government, the ESB has managed to come up with a scheme which could get bi-partisan support. At this stage there is quiet optimism however there are large concerns over the effect on contracting going forward. The ESB is looking for written submissions by 8 March 2018 and have the final design by the second half of 2018.

The forward prices generally reduced for 2019 as spot prices were less volatile than seen in previous years over summer. The exception was SA where there is still uncertainty around security of supply.

Table 1: ASX prices for Calendar Year 2019

| NSW | QLD | SA | VIC | |

| 1 DEC 2017 | 80.75 | 68.11 | 92.94 | 86.55 |

| 28 FEB 2018 | 76.38 | 64.03 | 94.36 | 82.90 |

The forward prices were lowest in QLD where we expect a large amount of new renewable generation to be built. Concerns over sufficient supply in other regions kept prices higher.

Despite higher forward prices and the highest average spot prices in the NEM, a hydrogen electrolyser will be built in Port Lincoln, South Australia. This will produce hydrogen using excess wind and solar (i.e. when prices are low) to produce hydrogen both to power a 10 MW gas turbine but also for export purposes. By using power intermittently, it is able to ramp up during low prices and not run during high spot prices which will also stabilise the grid and allow more wind generation to be dispatched in the region (wind in SA is currently being curtailed by AEMO to avoid frequency issues). It seems counterintuitive to put an energy intensive industry in SA however for very flexible consumption of electricity who are able to take advantage of low, or even negative, spot prices there is opportunity in the state.

If you would like to discuss the electricity market outlook and potential impact to your electricity portfolio, please contact Thomas on 07 3905 9226 or on 1800 EDGE ENERGY.