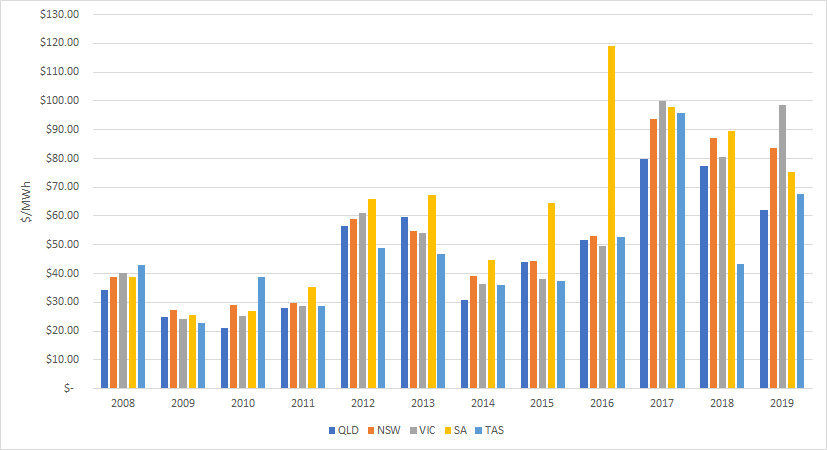

Electricity spot prices in Q319 (July to September) were relatively in line with Q3 2017 and 2018, however much higher than prices seen from 2014 to 2016 inclusive. Although, Q319 prices were softer than any other quarter for the year (2019) in majority of the NEM regions. The past three months have seen multiple negative price events in SA and QLD due to mild demand, constrained interconnectors and strong renewable generation volumes in solar (rooftop PV and large scale) and wind.

SA’s Q319 price is on a downward trajectory from the massive jump-up it experienced in 2016, taking with it NSW and QLD which both had lower Q319’s in comparison to the last 2 years. Whilst VIC and Tasmania’s Q319 regained in price post a slump in Q318.

Figure 1: Historical prices for autumn

(Source: AEMO)

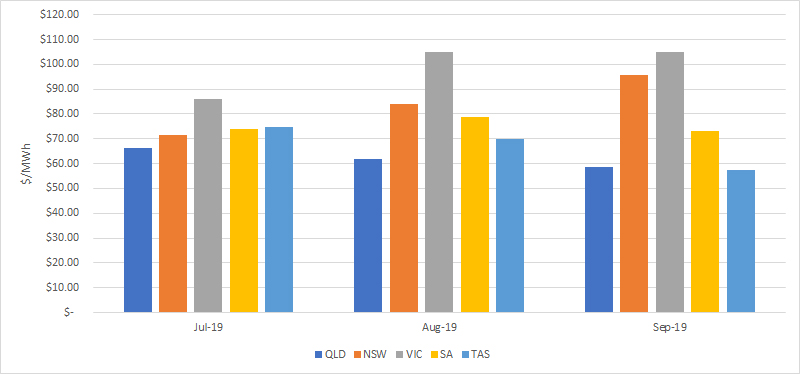

Throughout Q319 both QLD and SA experienced multiple negative price events and settlement periods. These events in QLD were lead by a combination of transmission line works on the QNI restricting its flow into NSW, low demand, strong solar rooftop PV and large-scale solar generation and interesting bidding behavior by QLD thermal generation.. Fuelling the low and negative price events was market participant bidding behaviour. It can be seen in the bid stacks, that around mid-August 2019, Stanwell Corp shifted an additional ~500 MW of generation to a bid band of < $0/MWh, leaving a good 3,000 MW exposed to prices less than $0/MWh. On a mild demand day in QLD with strong Rooftop PV, operational demand is lucky to reach 5,000 MW; add QNI in at 1,000 MW and the result is Stanwell bidding half of QLD demand + QNI at below $0/MWh.

SA’s multiple negative price events were also due to transmission line constraints restricting flows into VIC, and soft operational demand which was impacted significantly by strong solar rooftop PV and strong wind generation figures with an average volume of 600 MW. There were multiple weekends which resulted in several hours per day of negative pricing with Friday the 27th of September resulting in ~11.5 hours of negative half hourly pricing. The strong wind generation levels also meant AEMO had to issue directions to Pelican Point and Osborne gas fired power stations multiple times throughout the quarter for grid stability.

VIC and NSW prices across Q319 were both lifted by the Basslink outage which occurred on the 24th of August and lasted through to the 29th of September, resulting in no flows across the Basslink interconnector in either direction. During this time, VIC was heavily reliant on megawatts from NSW particularly during periods of low wind generation, whilst both regions were struggling with ailing baseload thermal plant issues and maintenance which was planned for the yearly shoulder period. The flip side of this? Tas was spared from the high price spikes experienced in VIC during this time which lead to a softened Q3 and September spot price for the region.

Figure 2: Average monthly spot prices in the NEM

(Source: AEMO)

Water levels at Snowy Hydro continued to increase at Lake Eucumbene over the quarter with levels now sitting at ~28.81 %, which is above the levels recorded the same time last year. The increased inflow of water volumes lead to a higher spill rate from Snow Hydro at Tumut, Upper Tumut (both NSW) and Murray (VIC) hydro plants. Additionally, issues with baseload thermal plant particularly in NSW and VIC lead to multiple gas peaking plants running to cover generation gaps at a higher price (due to higher cost of fuel).

Tas Hydro was able to conserve a fair amount of water in their dams over the period of the Basslink outage with storage volumes higher than they were a year prior, leading into the warmer months and Summer of 2019/2020.

With the increase in invoked constraints in QLD both inter and intra-regionally, QLD’s experienced 2 x five-minute VoLL spikes on the morning Wednesday 25th September. These VoLL spikes of $14,000/MWh and $13,998/MWh however were not so much due to market participant bidding or reflective of a market supply and demand squeeze, rather they were caused by both inter and intra-regional transmission constraints and limits imposed by AEMO. Transmission work was being carried out on lines impacting the QNI, forcing it to flow into NSW, whilst the QLD Central to Southern constraint was imposed, winding back generation north of Gladstone and Calvale. This meant that there was not sufficient enough generation in central QLD to satisfy demand, resulting in the bid stack climbing to $14,000/MWh to trigger multiple gas peakers and Wivenhoe who all reside south of Gladstone.

Also in this quarter we saw the release of AEMO’s 2019 ESOO which called out some imminent concerns for Summer:

- Forecasted tightly balanced supply and demand in several regions heading into Summer 2019/20, with VIC the only region forecasting an elevated risk of expected unserved energy (USE) currently not exceeding the 0.002% threshold (at 0.0026%).

- Potential risk to Summer 2019/20 if the Loy Yang A2 and Mortlake 2 remain on outage during the Summer period; AEMO are predicting 60% chance VIC’s Mortlake won’t be back for Summer 2020 and 30% AGL’s Loy Yang A2 won’t be back in time either.

- AEMO currently working to secure the maximum permissible reserves via the Reliability and Emergency Reserve Trader (RERT) to ensure Victoria’s reliability of supply meets the reliability standard for this summer.

The above lead to a rally in the futures curves particularly in Q419 and Q120 in VIC, SA, NSW and Tas. These are all regions that would feel the pinch of tightly balanced supply and demand with thermal baseload plant in the two major regions, NSW and VIC currently experiencing reliability issues. At this stage, MTPASA and market intel depicts that both Loy Yang A2 and Mortlake 2 will be online mid to late December 2019 just in time for Summer.

Looking Forward:

Figure 3: Calendar year 2020 forward contracts

| $/MWh | NSW | QLD | SA | VIC | TAS |

| 08-Oct-19 | $ 88.81 | $ 72.67 | $ 99.90 | $ 103.09 | $ 98.13 |

(Source: ASX)

The BoM is predicting a warmer than average Spring/Summer which should transpose to greater demand. This in turn could result in a greater need for supply generally resulting in higher spot prices. This should mean when the sun is beaming in QLD and the wind is howling in SA that the price should remain relatively high, enticing the generators to produce electricity and green certificates which have been a hot commodity in Q319. Despite this, NSW and VIC thermal plant are currently underway preparing for summer in what is generally coined their “summer readiness plan” utilising the shoulder period of the year to prepare plant for the warmer months. Transmission line work is likely to cease as we head into Spring/Summer also.

If you would like to discuss the electricity market outlook and potential impact to your electricity portfolio, please contact our Manager Wholesale Clients and Markets, Alex Driscoll on 07 3905 9220.