A statement released yesterday by the Queensland Government outlines its plan to put downward pressure on energy prices, generate jobs, and invest in renewables infrastructure.

The Queensland Premier, Treasurer, and Energy Minister jointly promoted the “Powering Queensland Plan” which will see the government invest $1.16 billion to ensure affordable, secure and sustainable energy supply for homes and businesses.

The plan shows several ways the government will put downward pressure on electricity prices. In the longer term, this includes:

- Reverse Auction of 400 MW of renewable energy including 100 MW of energy storage

- Improve project facilitation, planning, and network connections

- Implement an action plan on gas including purchasing gas fields

- Deliver a plan to improve generation in North Queensland

In the short term the plan will:

- Invest $770m to cover the cost of the Solar Bonus Scheme

- Restart Swanbank E power station

- Direct Stanwell to undertake strategies to place downward pressure on wholesale price

Swanbank E is a 385 MW combined cycle gas turbine which was put into long term care-and-maintenance (cold storage) in 2014 due to the market being over-supplied with generation. A previous statement from Stanwell had announced it would be back online at the end of 2018 if Stanwell determined it was required.

In addition to restarting the Swanbank E power station, the government will also direct Stanwell to undertake strategies to place downward pressure on wholesale prices. Stanwell is a large generation corporation which owns 3,689 MW of mainly baseload generation. This is without the additional capacity that Swanbank E will provide.

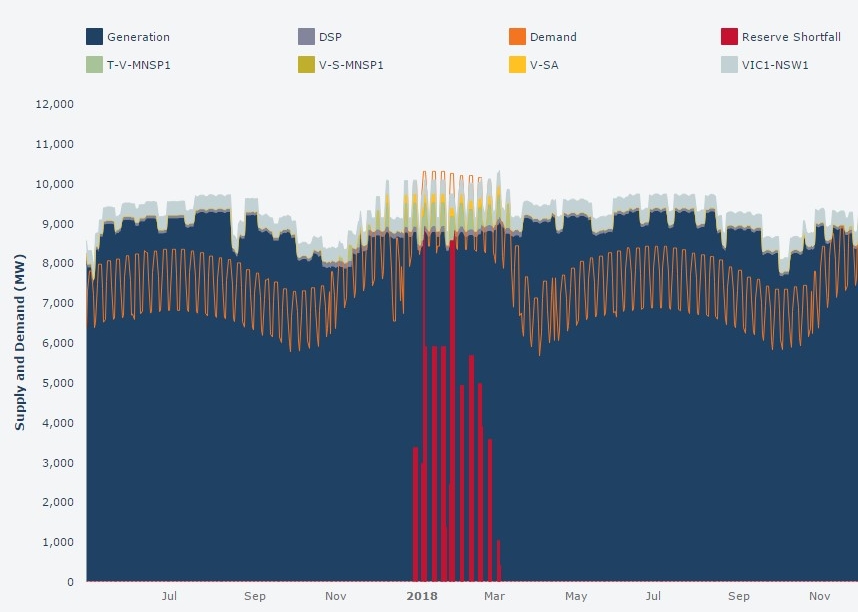

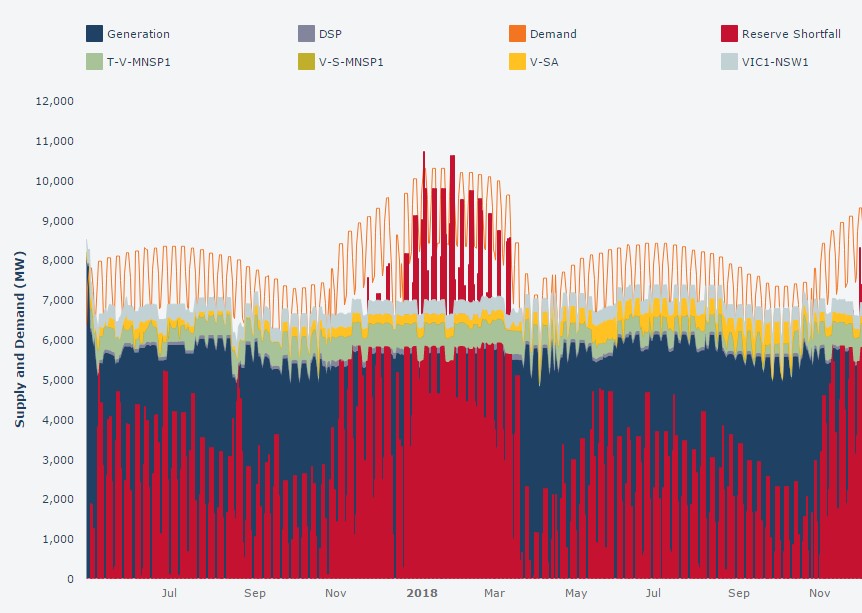

With the full details of the ‘Powering Queensland Plan’ delivered yesterday, there was immediate market movement.

The market reacted by reducing prices across the forward periods but particularly in the near term.

Queensland recorded the greatest reduction with a drop of $10.43/MWh followed by New South Wales which reduced $5.19/MWh. Victorian prices also reduced $3.40/MWh showing the importance of baseload generation in the current market.

If your business needs certainty around energy prices, please contact us on 07 3232 1115 to speak to one of our Senior Portfolio Managers.