Malcolm Turnbull was in Brisbane today promoting “lower energy prices” on the back of the public release of the ACCC’s “Restoring electricity affordability and Australia’s competitive advantage”. The 398 page report is extensive and contains 56 recommendations across the spectrum of the energy market. Edge highlights a couple of key recommendations below.

Recommendation 1

The NEL should be amended to prevent any acquisition or other arrangement (other than investment in new capacity) that would result in a market participant owning, or controlling dispatch of, more than 20 per cent of generation capacity in any NEM region or across the NEM as a whole.

The provision should be designed to prevent market participants circumventing the 20 per cent cap, including by way of ownership structure or contractual arrangements.

Recommendation 2

The Queensland Government should divide its generation assets into three generation portfolios to reduce market concentration in Queensland. The three portfolios should be of a similar size with a mix of generation assets to maximise competition in the wholesale market.

Once created, the Queensland Government should ensure that the three portfolios are separately owned and operated to maximise competition in the wholesale electricity market. The sale of any portfolios should be in line with recommendation 1.

Recommendation 4

The Australian Government should operate a program under which it will enter into low fixed-price (for example, $45–50/MWh) energy offtake agreements for the later years (say 6–15) of appropriate new generation projects which meet certain criteria. In doing so, project developers will be able to secure debt finance for projects where they do not have sufficient offtake commitments from C&I customers for later years of projects. This will encourage new entry, promote competition and enable C&I customers to access low-cost new generation.

The program should operate for at least a four-year period, with support provided for qualifying projects. To qualify, a project proposal must:

- have at least three customers who have committed to acquire energy from the project for at least the first five years of operation

- not involve any existing retail or wholesale market participant with a significant market share (say a share of 10 per cent or more in any NEM region)

- be of sufficient capacity to serve the needs of a number of large customers

- be capable of providing a firm product so that it can meet the needs of C&I customers.

Recommendation 5

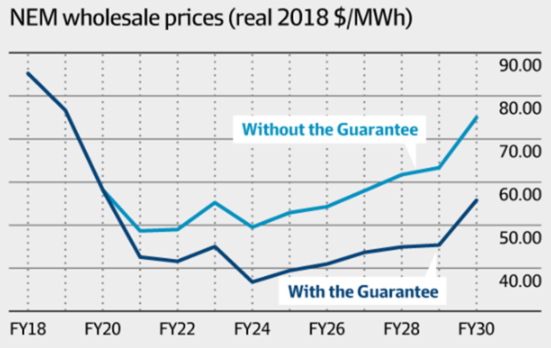

The National Energy Guarantee seeks to provide a settled policy framework under which new investment is encouraged in a way that enables achievement of the objective of reducing carbon emissions at low-cost while promoting investment in a manner that ensures demand for energy is met.

The ACCC agrees that this is an important policy objective and, with the policy incorporating appropriate safeguards for competition in the contract market, recommends that governments commit to develop and implement the National Energy Guarantee.

Recommendation 6

The NEL should be amended so as to require the reporting of all OTC trades to a repository administered by the AER. Reported OTC trades should then be disclosed publicly in a de-identified format that facilitates the dissemination of important market information without unintentionally revealing the parties involved.

The requirement should be implemented to align with (or be eligible for) any OTC reporting requirements under the NEG.

The AER, AEMC and AEMO should have access to the underlying contract information, including the identity of trading partners.

Recommendation 7

The AEMC should introduce market making obligations in South Australia, which require large, vertically integrated retailers to make offers to buy and sell specified hedge contracts each day, in order to boost hedge market activity. The parameters of a market making obligation should have regard to:

- the size of the South Australian market

- the distribution of generation ownership in the region

- the benefits to market liquidity and efficiency of regular trading activity

- the burden of the requirements on obligated entities

- any impact on the incentives of intermittent generators to invest in firming technology.

After an appropriate period of time (for example, after two years) the mechanism should be assessed for its effect on market activity, liquidity and risk to determine if it should be continued, amended or removed in South Australia and, potentially, extended to other NEM regions.

Recommendation 11

The governments of Queensland, NSW and Tasmania should take immediate steps to remedy the past over-investment of their network businesses in order to improve affordability of the network. With appropriate assistance from the Australian Government, this can be done:

- in Queensland, Tasmania and for Essential Energy in NSW, through a voluntary government write-down of the regulatory asset base

- in NSW, where the assets have since been fully or partially privatised, through the use of rebates on network charges (paid to the distribution company to be passed on to consumers) that offset the impact of over-investment in those states.

Such write-downs would enhance economic efficiency by reducing current distorting price signals. The amount of the write-downs and rebates should be made by reference to the estimates of over‑investment by the Grattan Institute, and should result in at least $100 a year in savings for average residential customers in those states.

Recommendation 21

In relation to wholesale demand response, a mechanism should be developed for third parties to offer demand response directly into the wholesale market. Design of the mechanism should commence immediately, building on work undertaken in the AEMC’s Reliability Frameworks Review. The mechanism should:

- promote competition through allowing the widest range of businesses to directly offer demand response services

- not allow retailers to limit the ability of their customers to engage a third party demand response provider (to the extent it is not inconsistent with the retail contract)

- ensure load and generation response are valued appropriately based on the benefit they provide to the wholesale market

- limit technical requirements placed on the customer that may inhibit take up or scope of these services (for example, requirements for multiple meters at the customer site).

Recommendation 24

The SRES should be wound down and abolished by 2021.

By in large the recommendations made in the report should help to put downward pressure on electricity prices. Mr Turnbull said today that if prices do not come down after implementation of selected recommendations that alternative actions will be taken.

The full report can be found on the ACCC website here.

If you have any questions on how you can achieve better pricing outcomes on your energy please get in contact with Edge on 07 3905 9220 or 1800 334 336.