In the brightest day and the blackest night, no opportunity shall escape my sight.

Ok, bar the bad Green Lantern pun, Green Hydrogen is the superpower on everyone’s lips at the moment. From the USA releasing its draft National Clean Hydrogen Strategy and Roadmap a few weeks ago, to the announced changes in the Hydrogen regulation in Europe, even Queensland has jumped on the press release bandwagon, announcing it as a cornerstone within its new Jobs and Energy Plan.

But what is this superpower? How can it help and what does it really do?

Well let’s start at the beginning, what is Green Hydrogen, why is it different to Grey or Blue Hydrogen and why is that important?

Green Hydrogen is produced by electrolysis, by splitting water into its base elements of Hydrogen and Oxygen. The reason it is Green is this process is done using renewable energy. The most preferred approach is to have this PPA (green energy) onsite and therefore Behind the Meter, however it is equally classified, at the moment, from other sources, with both the PPA and electrolyser being grid connected. Noting that there are additional costs if this is not co-located BTM generation as Network costs come into play.

The differential between this and Grey and Blue Hydrogen isn’t the process, but the fuel used to power the electrolysis. Grey Hydrogen comes from Natural Gas and Blue is from Gas but that is coupled with Carbon Capture and Storage (a technology which has been the silver bullet since I was at Uni and despite millions being pumped into the technology remains uneconomic and therefore unused).

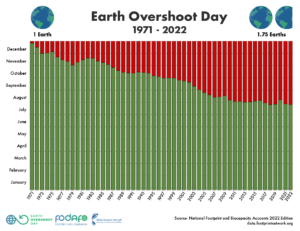

Why is this important – well to truly move towards a clean energy future, and for Hydrogen to play a large part in that, the technology used to create the hydrogen must be green, otherwise the end product (the hydrogen) is just an energy transition of the non-renewable source which was used to create it. This is why the Europeans (CertifHy) amongst others, will only allow Green Hydrogen certification from real PPA sources, not greenwashed with carbon credits, and certainly not from any other forms of electricity.

So how can the green hydrogen transform our supply? Well ignoring other uses of the fuel and export at the moment, transportation being a key area which could benefit as their fuel is hard to abate without a viable alternative as well as Ammonia and Methanol production. There is the obvious use if the fuel can be used for power supply.

This is moving closer with the planned Tallawarra B 200MW dual fuel power station (natural gas and green Hydrogen) due online in the summer of 2023/ 24. If this technology can be proven, this will be a huge source of clean energy which can be used for grid stability and baseload generation, it could also remove any bumps from the transition away from coal.

To give a sense of scale though 1KG of hydrogen is equivalent to about 33.3KWh of electricity. Last year the NEM supplied around 204TWh of electricity, so we would require around 6.2million tonnes (or 6.2billion KG) of Hydrogen to power the NEM.

Now the part to blow your noodle, to produce that 1Kg of Hydrogen we need to put into the electrolyser around 50KWh of electricity (taking a 67% efficiency rate for an Alkaline or PEM electrolyser, noting Solid Oxide electrolysers can have higher efficiencies.) Using this 67% efficiency rate we need to put in 310TWh of electricity to be able to produce the 240TWh required for the NEM. This is without factoring that Hydrogen which can be used for transportation and that which will be exported (with Japan underpinning many domestic projects how much will be available in Australia initially? But I said I wouldn’t be diverted to this today!).

This means the Hydrogen power industry alone has the capability to more than double the capacity requirements of the NEM. However, this requirement and thirst for power could be its real secret superpower.

Network constraints are the words every solar and wind operator hates, the renewable energy is being produced but either cannot be transported to the load centres or cannot be used in the local distribution zone and as such is wasted. Although the Hydrogen industry may not be able to use all this excess volume, especially in the near term, it certainly can absorb a large amount of it. Thus, reducing curtailment and increasing the renewable penetration to the grid.

But that isn’t its only superpower to assist with the balance of the grid, cast your mind back to this winter with curtailment being requested from every corner of the NEM. Rather than being the off-taker, the electrolysers can provide demand side management. They will naturally be programmed to react to the price and renewable energy generation signals anyway to be efficient. Therefore, turning up and down at these strained periods without needing market intervention will be a benefit we have not previously been able to tap into.

Hydrogen certainly looks to be the silver bullet this industry has been craving, and no one wants to be left behind when this train leaves the station. However, with so much in theory and nothing as yet proven to scale, we all hope that it doesn’t turn out to be the Aquaman of the superhero world.

Edge2020 provides energy management and advisory services to buyers and sellers of physical and financial energy products. We specialise in electricity, gas, renewable, environmental, and carbon products. Edge2020 can help ensure you achieve your business sustainability goals by supporting you with strategies that focus on minimising consumption and responsible purchasing of renewable energy. Reach out to our passionate team for support to improve your sustainability outcomes – email: info@edge2020.com.au