Now I am a major Game of Thrones fan, but I never thought moving to Australia that I would turn into Ned Stark and constantly worry about a Northern Hemisphere Winter. But, as we are hurtling towards those cooler months in t’north and following the tumultuous Q2 and start of Q3 in the NEM, I am preaching that the Northern ‘Winter is Coming’ and even down here in Australia we must be ready.

As background Northern Europe, UK, France, Belgium, Germany etc., rely on feeds of Gas from Norway and Russia. Gas is significant in Europe as a 1-degree shift in temperature can result in around 5% of domestic demand increase, or decrease, due to most homes being heated via Gas-Central heating. With a third La Niña about to be called in the Southern hemisphere and La Niña, correlated with colder winters in Europe, with increased snowfall, as it shifts the jet stream north to the pole and increases storms across Northern Europe, this can only mean an increase this heating demand.

This confluence of events would usually increase my concern for a tight supply in the European market, but this year is different. Ignoring for now the Russian flows, we will circle back to that later, Norway’s Energy Minister has already raised the possibility that they may restrict electricity exports with possible restrictions to Gas flows as well. With much of their electricity coming from hydro, and after an un-seasonably warm summer period, Norway has stated the priority will be to refill the reservoirs over winter, rather than secure the energy supply of their European neighbours. With this flow being restricted into Northern Europe, coupled with a diminishing fleet of coal and nuclear options, gas will be the favoured source of domestic supply for Northern Europe. Although there are other interconnectors, it is anticipated these will either be significantly under utilised or such a price differential within a domestic market will occur to ensure flows to a single market will ensue. This could be facilitated by pushing those areas (countries) price up to exorbitant amounts to ensure flow across the interconnector and shore up domestic supply. With flows of course favouring higher priced regions.

Now let’s put Russia into the mix. Russia announced this week that the Nord-Stream 1 pipeline, a crucial pipeline for gas flow into Europe, required maintenance from the 31st August. This happens to coincide with European markets trying to firm up winter supply by filling storage and Russia increasing aggression to the Ukraine, but I am sure that was a coincidence.

The 3-day maintenance will have a return to service for the 2nd September. But how likely is this to return? Well, if the last outage is anything to go by, where only 40% of the required flow reached Europe and the delivery of the required turbine was strangely delayed, the price increase was significant and totally in Russian control. Now with this latest outage and flows expected to be around 5% of the obligations agreed with the EU, the cynic in me wondered if Putin is trying to offset the sanctions place on Russia by pushing the cost of Gas to exorbitant amounts. If he can sell his 5% for the same as the revenue from the already inflated 40% and free the remaining gas for sale to more amiable neighbours, he is in a win-win situation.

The real fear is that this flow remains low for the whole of Europe’s winter, which would not only put massive strain on the cost of generation but also lead to many retailers simply not able to meet their obligations and go under. There is also a risk of lack of supply and therefore blackouts as well as increasing costs on an already strained economic environment.

To mitigate this, European generators are throwing out their climate targets with the baby and the bath water in favour of supply and are scrambling to shore up gas supply and return coal-fired power stations from cold storage. The Mehrun Coal-Fired Power plant in Saxony Germany came back online at the start of August, Uniper have just announced they are re-commissioning the Heyden plant in North Rhine-Westphalia and in the UK, the government has made moves to re-open the rough gas storage facility, 25% of it initially, ignoring the safety concerns which led to its original closure. But this will not be enough, and this is where Australia needs to brace itself for a secondary wave of impacts.

LNG and coal exports into Europe will increase, as the price differential will be significant. The ensuing impact through the JKM on the domestic gas market, and coal export price will affect the replenishment of the longer-term running costs of our own generators.

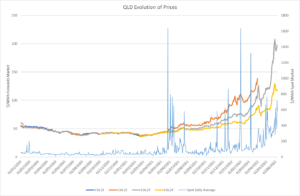

Although significant volume should be pre-hedged, these prices will start feeding through, nothing is stopping the trading opportunity cost being passed through by generators. They will argue the replenishment of the stockpile will need to factor these spot and forwards prices, interesting that doesn’t flow through in a bear’s market though. What does that mean for our summer, well it means the high prices aren’t going anywhere fast. The shortage of supply in the NEM may be diminished, with most, if not all units now returned from overhaul, yet the price is continuing to take advantage of, and reflect the international fundamentals rather than the real long run average cost of the asset.

With the Capacity Mechanism being put on ice and strengthening Safeguard Mechanisms already announced by the Labor Government, coupled with favourable international fundamental conditions providing political cover for generators, could this be the last hurrah for coal and gas generators to eek the last value from these assets?

Either way be under no illusions, with the Northern winter hurtling towards us, European prices already building in shortfalls in supply and no end to the Ukraine conflict in sight, the Vega sensitivity is going off the chart and is not going to be subsiding anytime soon. As such Australia, and especially its energy markets need to brace, for the fallout.

To circle back to Game of Thrones, Ramsay Bolton stated, “If you think this has a happy ending, you haven’t been paying attention” for ‘winter is coming’ and we must be prepared.