Edge Insights provides you with the latest news in the energy industry and showcases some of our services that help to ensure businesses maintain their optimal energy arrangements at all times. In this edition:

- Hazelwood Closure Impacts East Coast Prices

- Softening of LGCs

- Student Gains Work Experience

- Energy Snapshots

- Gas Market Update

- National Electricity Update

NEWS OF HAZELWOOD CLOSURE

|

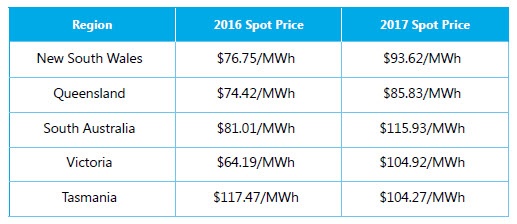

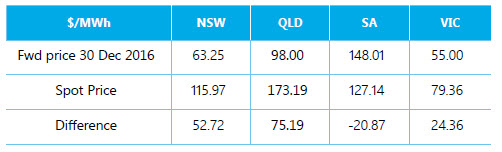

November’s announcement by Engie regarding the closure of Hazelwood power station has seen an increase in east coast energy prices.

While the largest increases have been evident for Vic where Hazelwood is located, there has also been an impact on prices in NSW and Qld. Most of the increases have been contained to 2017 prices with smaller increases in 2018.

The loss of Hazelwood is likely to be replaced in the short term by increased generation in NSW. Vic has a target to reach 25% renewable generation by 2020 and 40% by 2025. This should be able to replace the output of Hazelwood.

|

There is no doubt that the loss of Hazelwood will cause increases to prices and fewer available hedges to be bought. With NSW already facing a shortage of generation and SA relying on Vic at times of low wind, the prices in these regions are likely to increase.

Qld has been less affected as it does not border Vic but by constraining support to NSW, it has also increased. Vic has enjoyed the lowest wholesale electricity prices in the National Electricity market but the forward prices beyond Q1 2017 are now on par with other states.

Engie is also exploring what to do with its other brown coal plant in the state and has announced that it would be willing to sell if the price is acceptable.

|

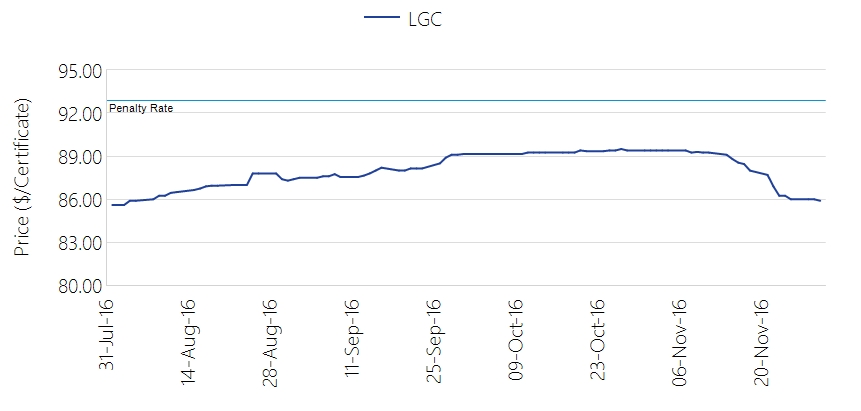

SHORT TERM SOFTENING OF LGCS

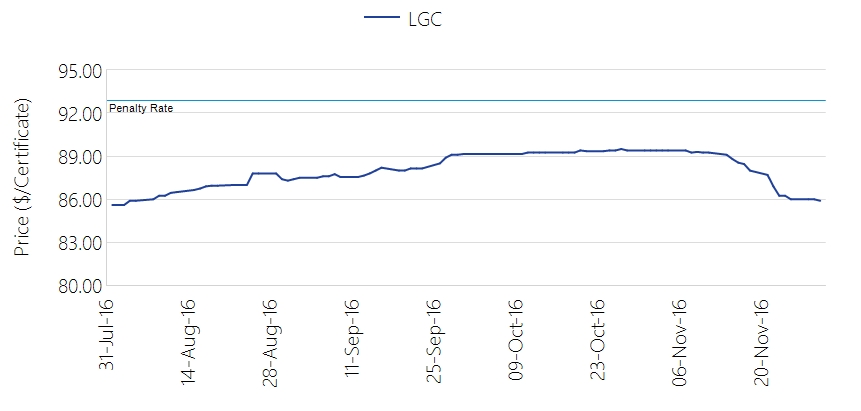

There has been a softening in the price of Large-Scale Generation Certificates (LGCs) after increasing for much of 2016, as retailers become concerned about the possibility of a sustained drop in prices.

After sitting at $89 / certificate for many months, prices started to reduce over recent weeks. Retailers who have renewable generation coming online over the next two years became concerned they could end up with large inventories of certificates in a falling market. This has led to some selling at high prices.

Concern in the market that uptake of new renewable generation cannot keep pace with surrender obligations had originally led the price of certificates to approach penalty rates.

482 MW of renewable generation is due to be built with funding from The Australian Renewable Energy Agency (ARENA). This is a major step, but at least 10 times as much will need to be built in coming years to meet targets for 2030. This makes it unlikely that there will be a sustained drop in price. It is more likely that the price will start trending back towards penalty price.

|

STUDENT GAINS REAL-LIFE EXPERIENCE AT EDGE

Introducing our Work Experience student, Hayden!

Hayden comes to us from Nursery Road State Special School where he is currently completing Year 12. The school offers a number of different programs catering for children from birth to 18 years with a strong focus on teaching with individual needs in mind. The programs are implemented to give students a learning pathway to functioning independently.

Edge has been an avid supporter of Nursery Road State Special School for many years. So, when we were approached to consider taking on a work experience student – we jumped at the chance.

Work Experience is a valuable tool to provide students with real-life experiences that build skills and confidence.

Hayden joined our team in July and settled in quickly. He helps to keep our office in smooth running order and is always ready to learn new tasks. His Friday visits always end with morning tea which Hayden tells us is his favourite part.

Learn more about Nursery Road State Special School

|

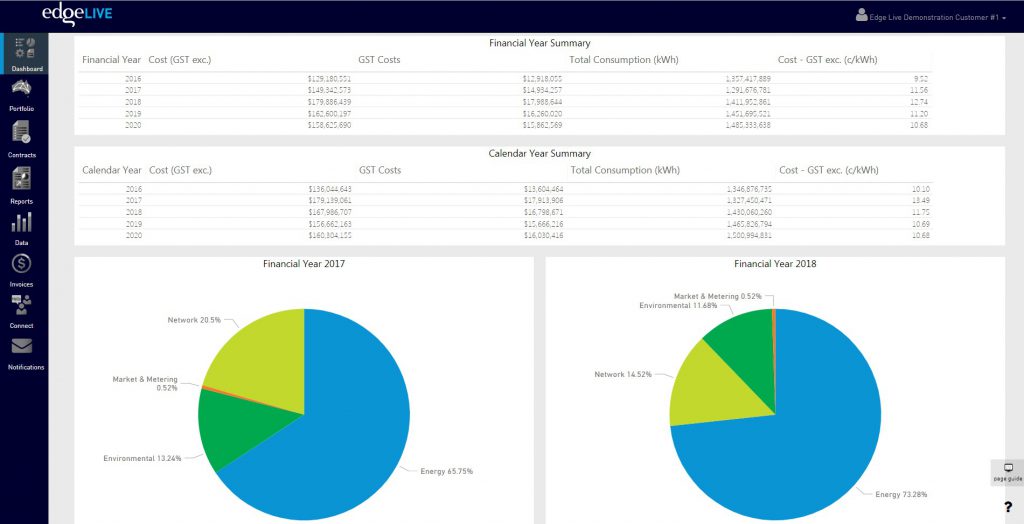

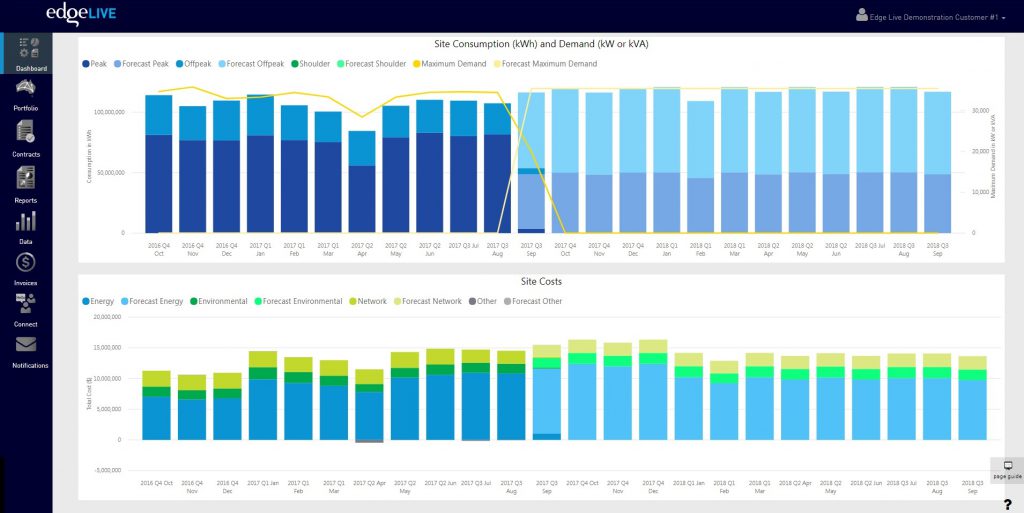

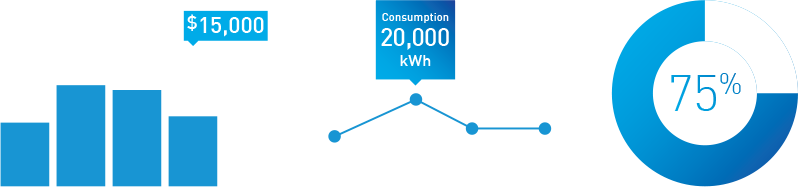

SNAPSHOT REPORTS DATA AT A GLANCE

Effective management of an energy portfolio requires significant attention and expertise. The portfolio needs to be continually monitored and reviewed to ensure optimal outcomes in key areas.

We often find that the time and knowledge needed to efficiently manage a sophisticated energy portfolio can be difficult to find within large and small organisations alike. There is also an overwhelming consensus among energy customers that the ability to view cost and consumption data in one place is critical to making decisions.

Our extensive experience with managing electricity for clients has meant that we have been able to develop a reporting tool that provides you with accurate insight into how your portfolio is operating at a specific point in time. This experience coupled with our constant review and analysis of the market, and discussions with industry counterparties brings an unprecedented depth of knowledge that you can access by engaging Edge.

We also provide full transparency of the underlying data, for those in your organisation who prefer to analyse the numbers.

The report can be tailored to your specific requirements. Our clients use the report for a wide range of purposes.

– reviewing the outcome of our invoice reconciliation process to make a decision on invoice approval for payment

– financial history of individual sites and the overall asset (Annual, monthly or by financial year)

– forecasting costs and consumption based on historical outcomes and projected operational changes

– consumption and demand history for each site or at an overall asset level.

With this information at your fingertips, you can translate energy consumption into actual costs, provide accurate forecasting to your finance teams and have the peace of mind that the bills you are paying are true and correct.

The Snapshot Report is an easy to read graphical representation of your energy consumption and costs.

Our clients continue to save time and money with this report. Contact us to see how the Snapshot Report can work for your business.

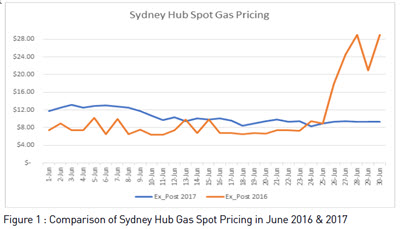

STATE OF THE MARKET – GAS

What is happening to gas prices

After unprecedented high spot prices in the winter months, there has been a softening across the short term trading market (STTM) recently. High spot prices in winter is characteristic of usual seasonal adjustments, however gas supply issues coupled with higher than expected demand pushed spot prices well above historical figures. With regards to recent spot prices, there has been a notable increase in prices from the same time last year. Pricing is currently sitting on average above $7/Gigajoule (GJ) across the three hubs of Sydney, Brisbane and Adelaide. This time last year Adelaide was sitting at $4/GJ, Brisbane at an average of $2.89/GJ, and Sydney around $3.90/GJ.

Queensland LNG industry

October signalled the start of operations for Australia Pacific LNG’s (APLNG) second gas train on Curtis Island offshore of Gladstone. This completes the construction of three major Liquefied Natural Gas (LNG) projects that were proposed under the Queensland Government’s “Blueprint

for Queensland’s LNG Industry”. The projects consist of six trains and three LNG processing facilities that have the capacity to export up to a combined total of 25.3 million tonnes per annum (Mtpa). The pipelines are contracted to deliver 4,520 terajoules (TJ) to the three facilities, with an average of 3,300 TJ currently being delivered per day.

AGL outlines a move into WA market

AGL presented growth opportunities at its investor day held in November that gained some interest in the market. The company announced it will enter the WA Gas Market from January 2018. AGL announced an aggressive acquisition target of 100,000 customers within the first two years. Alinta Energy currently holds an estimated 90% share of the WA market, with Kleenheat holding the remaining 10%.

This move will certainly be a key driver for increased competition in the WA market providing customers with opportunities to make potential savings in future years. By making this move, AGL also puts itself in prime position to be able to swiftly enter the retail electricity market if and when it becomes contestable.

AGL considers LNG import facility

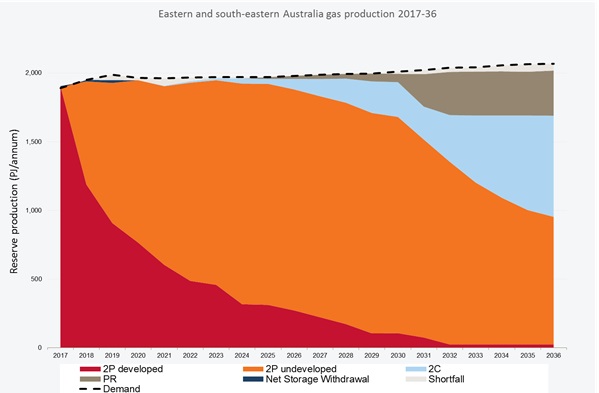

AGL has also announced a $17m feasibility study to build an LNG import facility, with a terminal potentially available by 2021. Given that there is a declining gas supply (2P reserves) on the east coast of Australia, opinion suggests that more needs to be done to secure forward gas for the domestic market.

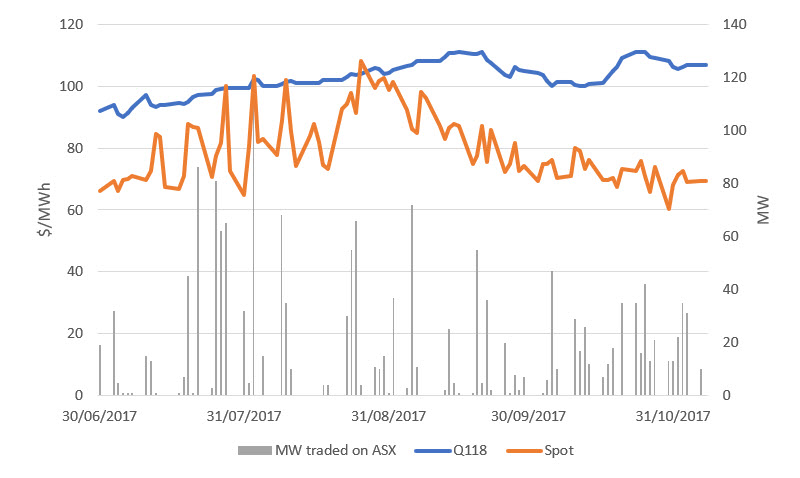

NATIONAL ELECTRICITY MARKET OVERVIEW

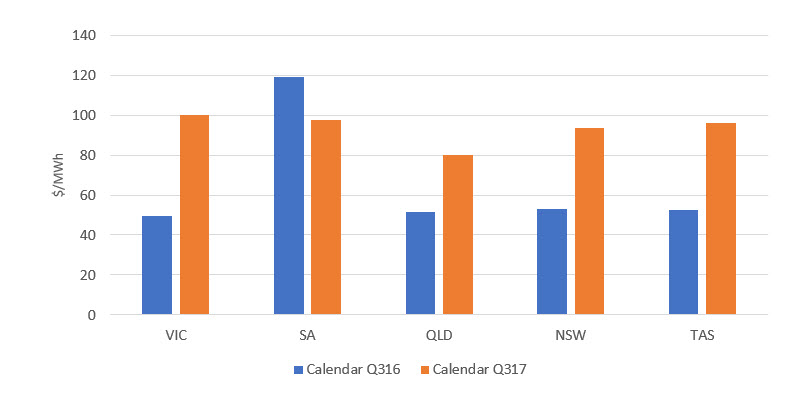

Q316 started where Q216 left off with high prices across the National Electricity Market (NEM).

Generation availability continued to be the main issue for other regions. There had been a number of generator outages during Q216 and some of these had failed to come back by Q316. The first two weeks of Q316 averaged between $83/MWh and $92/MWh for all regions excluding SA. After the generation came back online the prices normalised and prices were in the range of $42/MWh and $46/MWh for the remainder of the quarter.

Overall the dominant theme was availability of base loading plant. There were a number of trips on large base loading plant and a delayed return to service once they were off. The market is now unsure how stable the generation is, particularly in NSW. There is also concern that any exit will be disorderly as there is not much spare capacity left in the system. These concerns were made worse when Engie announced it would close its Hazelwood plant in Vic. This would mean less support from Vic in the future.

SA had a turbulent quarter. It started with record high spot gas prices, high demand due to cold weather, and limitations on the interconnector with Vic. Pelican Point, one of the state’s largest power stations, chose not to operate for the first two weeks of the quarter. This was the first full quarter without any coal-fired power generation in SA.

During the first two weeks the average price was $379/MWh and large users were concerned they would be unable to continue if the prices didn’t reduce. The SA government stepped in and negotiated for Pelican Point to start up while the interconnector was being upgraded. Prices became subdued, however they were still higher than other regions. The price for the rest of the quarter was $73/MWh.

Towards the end of the quarter SA experienced a major energy shutdown, now known as the ‘SA Black System’. The grid was slowly restarted overnight but the competitive market was suspended

for a further two weeks.

As a result, the Council of Australian Governments (COAG) Energy Council is currently looking into what needs to change to better integrate renewable generation into the NEM.

Full PDF edition: Edge Insights – Issue 2