It is no surprise, when I say the National Electricity Market (NEM) is going through a vast transition and transformation, with an ever-increasing penetration of renewable generation, in the form of both utility scale renewable generation and household installations.

The world as we know is also battling the global pandemic that is Coronavirus. This has had a significant impact on people and their livelihoods and health. along with a significant impact on energy markets around the globe. To top it all off, energy markets have had to endure a supply price war recently, between OPEC’s unelected leader, Saudi Arabia and non-OPEC oil producer, Russia.

With a rapidly evolving and ever-changing energy landscape, what should our contract markets look like? Are the current products fit for purpose or offer value in an energy landscape like the NEM? As a generator, the days of capturing value and running flat out all hours of the day, are indeed starting to dwindle, with quick, nimble, and easily dispatchable fast-start generation likely to excel in the near to longer-term landscape. Take South Australia (SA) as a good example, as to the success of fast-start plant. On the 04/04/2020 at 12:00pm, the 5 minute spot price was down at -$1,000/MWh, which is where it stayed the majority of the morning, due to low demand and strong generation, trying to send megawatts into Victoria (VIC), maxing out the interconnector. Shortly after that, at 12:20pm, prices spiked to above $300/MWh for the next 30 to 40 minutes or so, with fast-start gas generation swooping in and capturing this short-term high price period.

If this type of generation is the key to success in this new look NEM that we operate in, where fast-start, short burst generation is taking its place to complement the intermittent renewable generation in wind and solar, utility or household, that continues to penetrate the market, why are our contract markets continuing to predominantly offer baseload swaps?

A baseload swap is a contract for energy, say 5 MW for $70/MWh, for a defined period, for a month, a quarter, a calendar, or financial year. The way a swap works is the $60/MWh becomes the strike price in which the seller of the swap pays the floating price (the price of the underlying wholesale product which is electricity in this instance) and the buyer pays the fixed $70/MWh.

Say you have contracted a baseload swap for 5 MW for the entire calendar year of 2020, this would mean that for every half hour (with electricity settling every half hour as per the underlying wholesale market settlement regime in the NEM), of the entire 2020 calendar year, the buyer will pay the seller $70/MWh, and the seller will pay the buyer the underlying wholesale or spot price. For example, say this morning the wholesale or spot price for electricity for the half hour ending period of 9:30am was $40/MWh; this would result in the buyer paying the seller $70/MWh for 5 MW, whilst the seller would pay the buyer $40/MWh for 5 MW, resulting in a $30/MWh contract for difference (CFD) payment going from the buyer to the seller.

However, think about this, the baseload swap is exactly that, baseload. So, a contract for calendar year 2020 means you are locked into that same position (unless you sell out of the position) 24 hrs, 365 days.

So, do baseload contracts offer appropriate value anymore, in a market which are short-lived upward volatility and recently longer periods of downward volatility?

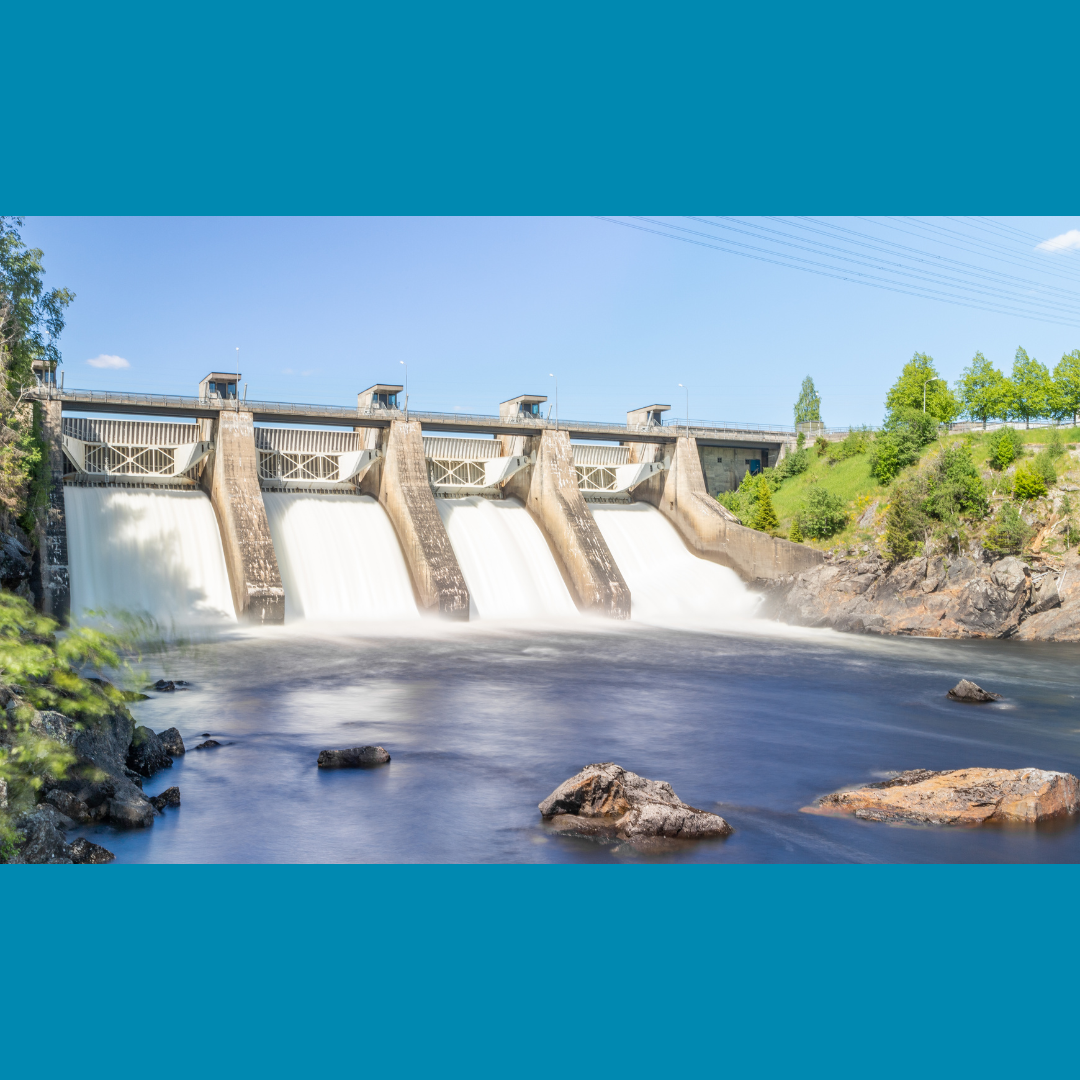

Mid last month, Snowy Hydro struck a contract defined as a ‘super-peak’ swap, which will cover what has been defined as the “super peak” periods of the day, generally morning and evening peak usage when solar is ramping up or down. The trade was brokered through an over-the-counter (OTC) trading hub operated by Renewable Energy Hub, and it is believed, similar deals will be a gateway to funding and bringing into the market technology such as batteries and demand-response into the energy markets.

Snowy Hydro has been procuring renewable PPA’s for a while, through wind and solar generation, including the 90 MW it procured from the Sebastopol Solar Farm in NSW. They are looking to use the renewable generation and back it with their significant hydro fleet, to sell a new range of products to its customers.

With wholesale energy prices reducing significantly since September 2019, and the overabundance of generation in states such as QLD and SA, and with the rapid introduction of new technology, it is likely a significant number of customers will choose to take more wholesale/spot price exposure, rather than contracting ahead of time.,

This fuels the argument for the need to have more flexible and robust products, ones that are for particular trading intervals, perhaps in the day, day-ahead products, week-ahead products, or perhaps more products like Snowy’s ‘super peak’ product?

If you have any questions regarding this article or the electricity market in general, call Edge on 07 3905 9220 or 1800 334 336.