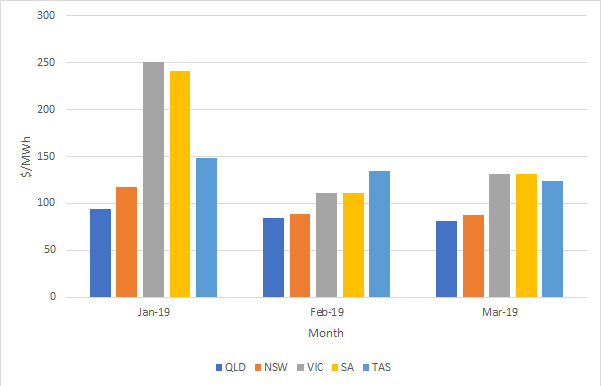

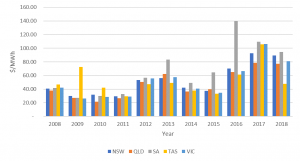

The electricity spot prices were higher for the Summer period (January – March) compared to the preceding three months. Although demand remained static, prices increased as a result of coal and gas generation setting prices at elevated levels. Average prices increased in all regions from the previous summer, with Queensland increasing the least at 23% and Victoria increasing the most at 62%.

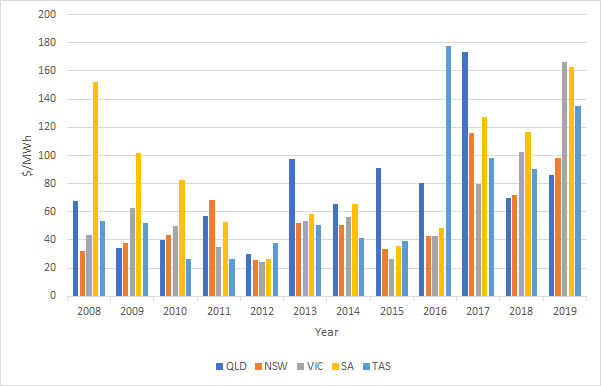

Across all regions, prices during the 2019 summer were higher than the 2018 summer and were very high in a historical context for Victoria, South Australia and Tasmania. Looking back across the last 10 summers, 2019 summer prices are at their highest levels in most states.

Figure 1: Historical prices for summer

It should be noted that prices in both 2012 and 2013 were affected by a carbon tax, which was subsequently repealed in 2014. Since then, there has been a steady price increase in all mainland NEM regions. In Queensland, the Government provided a direction to Stanwell Corporation and CS Energy to adopt strategies to reduce wholesale prices. Since the direction, there have been fewer price spikes (prices above $300/MWh), although average prices have continued to increase.

Price spikes in late January for NSW, South Australia and Victoria were driven by a combination of the following factors:

- the lack of wind generation;

- reduced limits on interconnectors;

- reduced thermal generation output; and

- hot weather increasing demand.

High temperatures also increased demand for Queensland in mid-February, pushing demand to 9,988MW.

The New South Wales market was relatively stable over summer with limited volatility. Throughout the season, prices only spiked above $500/MWh for the trading interval on 2 occasions. Snowy Hydro continues to draw down its dam levels to cover cap contracts and supress prices below $300/MWh.

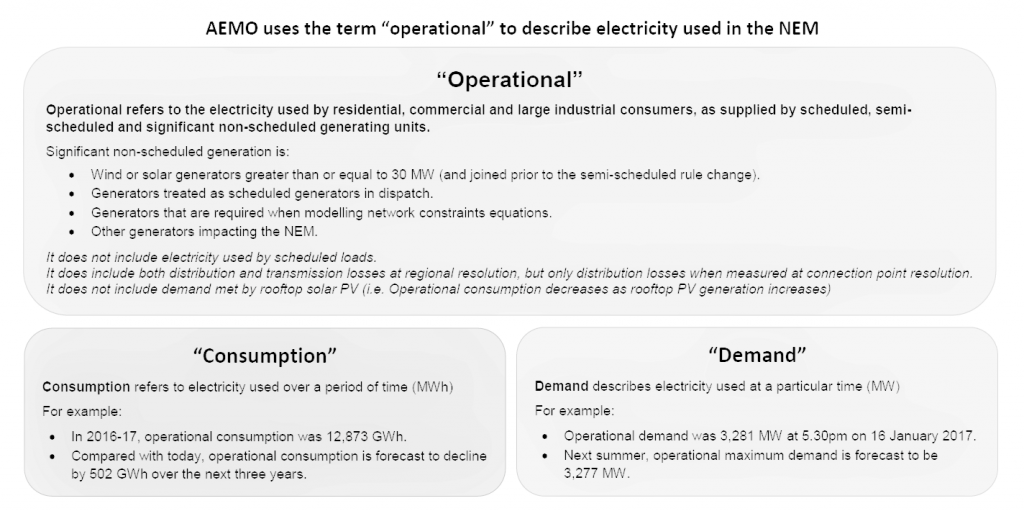

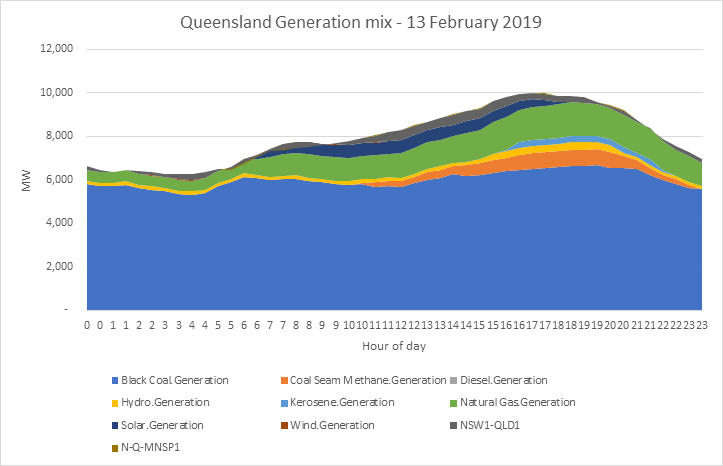

Quarter 1 2019 saw a lower level of generation for gas powered generators as a result of the increased level of generation from renewables and the rising cost of fuel. Renewable generation continues to grow to over 3GW from the start of the year. Operational demand dropped to its lowest level since 2002 as a result of a reduction in energy intensive industries and the increased uptake in rooftop solar PV.

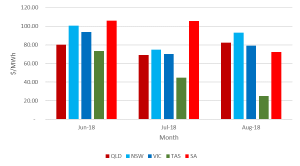

Figure 2: Average monthly spot prices in the NEM

Coal fired generation was at its lowest level since the start of the market on 13 December 1998. This lower level of generation was driven by prolonged outages at Yallourn and Loy Yang A and the increase in market share from renewables. Coal fired generation was also impacted by an increased number of trips, increasing from 10 in the previous quarter to close to 30 in Q119.

Hydro generation was reduced driven by lower dam levels or water conservation strategies by Snowy Hydro in New South Wales and Victoria, and Hydro Tasmania in Tasmania.

Looking forward

Higher spot prices and concerns over the stability of the grid have caused the forward curve to increase. Snowy Hydro continue to draw down on its dam reserves and with a dry outlook, the inflows could be lower than previous years. If Snowy Hydro reduce output during 2019, spot prices could be even higher than current prices.

There is currently a huge pipeline of committed projects waiting to enter the market. These projects are mainly renewable energy, diesel and batteries. The integration of renewable energy generation into the market and the strategies of price setting coal and gas generation will determine if prices will reduce or if a more volatile market will be created. It is unlikely in the near term that spot prices will return to historical levels as renewable generation has not reached the volume required to consistently set prices at lower levels.

If you would like to discuss the electricity market outlook and potential impact to your electricity portfolio, please contact our Manager Wholesale Clients and Markets, Alex Driscoll on 07 3905 9220.