In late 2017, the Energy Security Board (ESB) developed a scheme to provide investment certainty in the electricity market, which would address Australia’s commitments under the Paris Agreement.

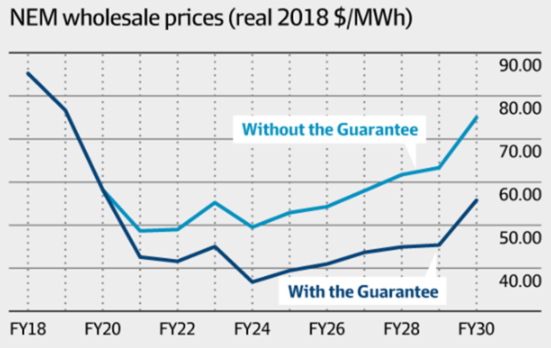

The Coalition had ruled out a carbon tax, other cap-and-trade schemes and virtually any other scheme which had been attempted in the past. This left very few options for the ESB to appropriately address investment certainty in the electricity market. The ESB eventually developed an innovative scheme called the National Energy Guarantee (NEG). The basis of the NEG was essentially a cap-and-trade scheme for environmental certificates and, as a sweetener, it also had a reliability obligation. Essentially, the scheme was linked to contracts with retailers to make it sound like it wasn’t a cap-and-trade scheme. The reliability obligation would force retailers to purchase firm contracts if there was a reliability gap. The additional demand for firm contracts was thought to increase demand for firm generation.

The Australian Labor Party (ALP) was willing to support the NEG on the assumption that they would be able to increase the target for carbon reduction. The states were also largely on-board, on the basis that state-based schemes could continue under the NEG.

The new focus of the Federal Government will be reducing prices in the energy sector.

Prior to the legislation being enacted, Malcolm Turnbull was removed as Prime Minister. Even though Scott Morrison, the succeeding Prime Minister of Australia, had previously been supportive of the NEG, he conceded that it would no longer be acceptable to his party and declared the NEG dead. At the same time, the Australian Competition and Consumer Commission delivered a paper suggesting ways of reducing electricity prices. The new Energy Minister, Angus Taylor, was nicknamed the “Minister for Bringing Prices Down” declaring the new focus for the Federal Government in the energy sector.

Subsequently, the ALP has been quietly arguing for bipartisan support to potentially revisit the NEG in its entirety. Recently, Mr Morrison has been open to the reliability portion of the NEG being resurrected. Mr Morrison has expressed interest in meeting with the states and territories to discuss the possibility of legislating the reliability aspect of the NEG on its own.

While the NEG is still a topic of conversation in parliament, it seems that only the reliability obligation may survive.

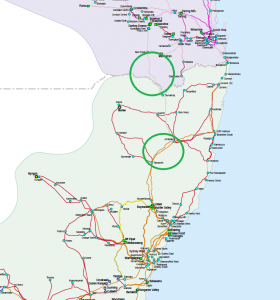

As a whole, energy policy is shaping up to be a key differential in the next Federal election. In the meantime, we are seeing renewable projects going ahead across the entire system. Australia is well on track to meet and exceed the current 2020 target of 33,000 GWh of renewable energy across Australia. New investors in Australia are coming to terms with political instability, instead focusing on setting projects up directly with businesses that are considering their own schemes due to the lack of political leadership shown in Parliament.

As we come towards the end of 2018, the outlook is grim for bipartisan support of long-term energy policy; however, we may still have a way forward as consumers start to forge ahead of the political vacuum. The Federal government has warned against businesses forming a technocracy to effectively create laws, however given the failure of the government to provide an alternative, this may be the way that policies will be formed going forward.