There is no doubt that energy markets and the energy industry itself are rapidly evolving and moving away from fossil fuels. The evolution of energy seems to be coming, and only coming faster given this tumultuous time the people and countries across the world have endured. Lets start with oil; Australian’s across the nation are very aware of the recent global oil price crash to new historic levels, particularly when it is reported in the news headlines that Australian’s are seeing almost 15-year lows at the petrol bowser. The impact of the recent oil price crash however does not stop at the bowser, it has and will continue to have significant impacts on energy markets across the globe including in Australia.

Oil prices have been hit recently due to two major events; one being the global epidemic of COVID-19, resulting in a significant reduction in demand for oil across the globe. The International Energy Agency’s (IEA) April 2020 reports an expected drop in demand of global oil of 9.3 million barrels(mb)/day year on year for 2020, with April 2020 demand estimated to be lower than 2019’s demand by 29 mb/day. The second impact to oil markets has been the oil price and supply war between OPEC’s pseudo leader Saudia Arabia and non-OPEC nation, Russia, two of the largest global oil exporters. Saudi Arabia and Russia could not agree levels of supply, leading to Saudia Arabia flooding the market with oil and prices, both spot and futures, reaching new lows. The quarrel between the two global oil market power-houses and the impacts of the COVID-19 on demand for oil has led to the historical event where the West Texas Intermediate (WTI) oil price index fell into negative price territory, with May 2020 future prices settling at -USD$37.63/barrel on the 20/04/2020, after reaching a low of -USD$40.32/barrel earlier that day.

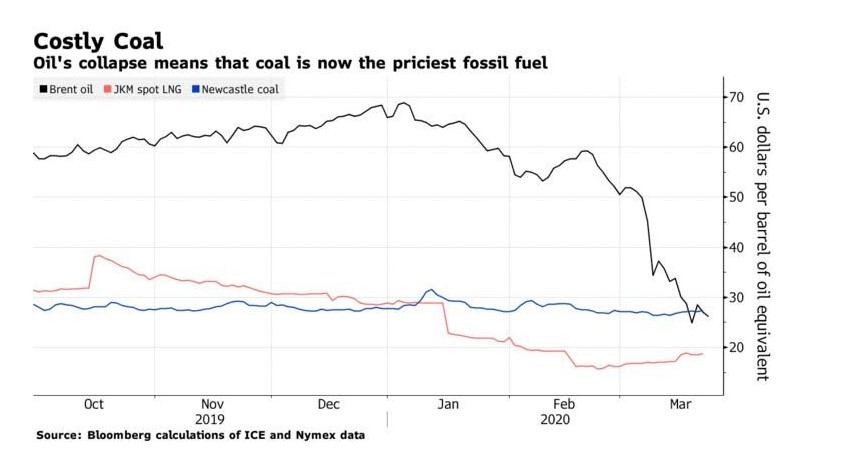

The major oil index, WTI, saw futures prices for June 2020 contracts settling at around USD$17/barrel on the 29/04/2020, whilst Brent Crude, another major oil index also felt the pain of slowing demand, with prices dropping below USD$20/barrel on the 27/04/2020. But the impact of tumbling oil prices reaches far and wide, particularly here in Australia. Australia has a booming natural gas industry and was the largest exporter of liquified natural gas (LNG) as of January 2020. A significant number of gas sales agreements are linked to the crude oil indices, with Australian gas companies feeling the hurt given the tumble in oil prices. Brent Crude oil futures for June 2020 contracts settled at around USD$24/barrel on the 29/04/2020. At these prices, the likes of Santos and Oil Search will be hurting given both flagged a cashflow breakeven oil price of ~USD$25-29/barrel, and USD$32-33/barrel, respectively. Demand for natural gas in international markets has also tumbled, and due to the linkage between oil prices and gas contracts, spot contract prices have shifted down, with June 2020 contracts settling at AUD$2.87/GJ (~USD$1.88/GJ) as of the 30/04/2020, again a far reach from prices seen in November 2019 of ~AUD$7.30/GJ (~USD$5/GJ).

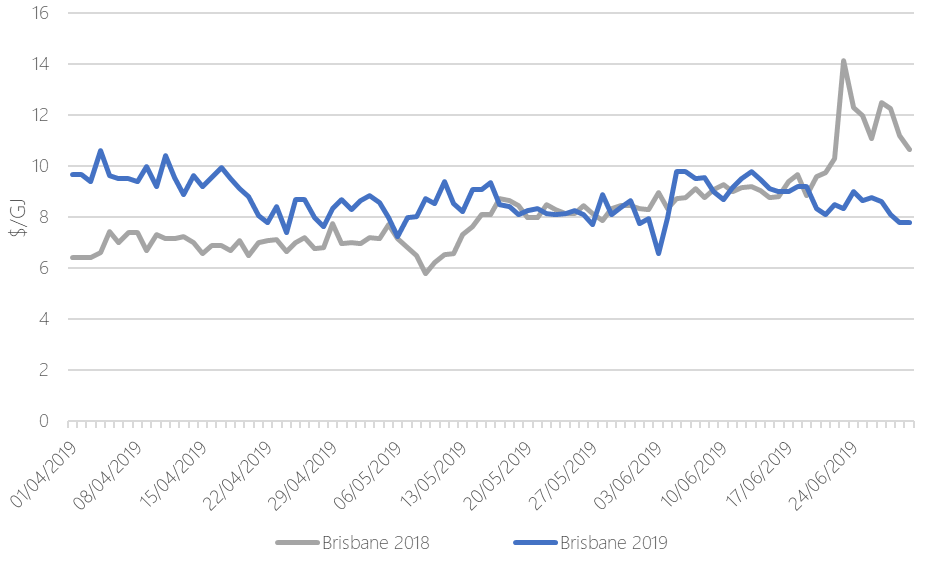

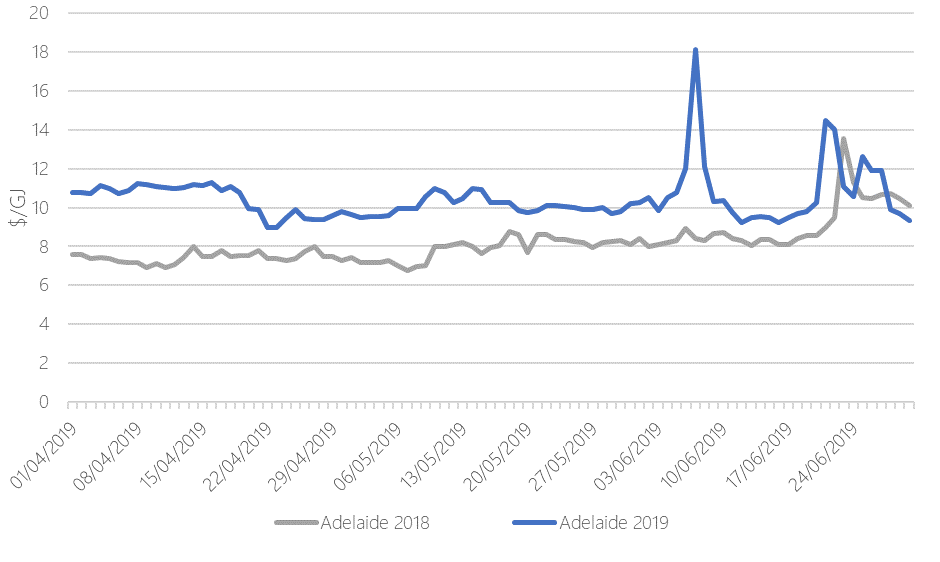

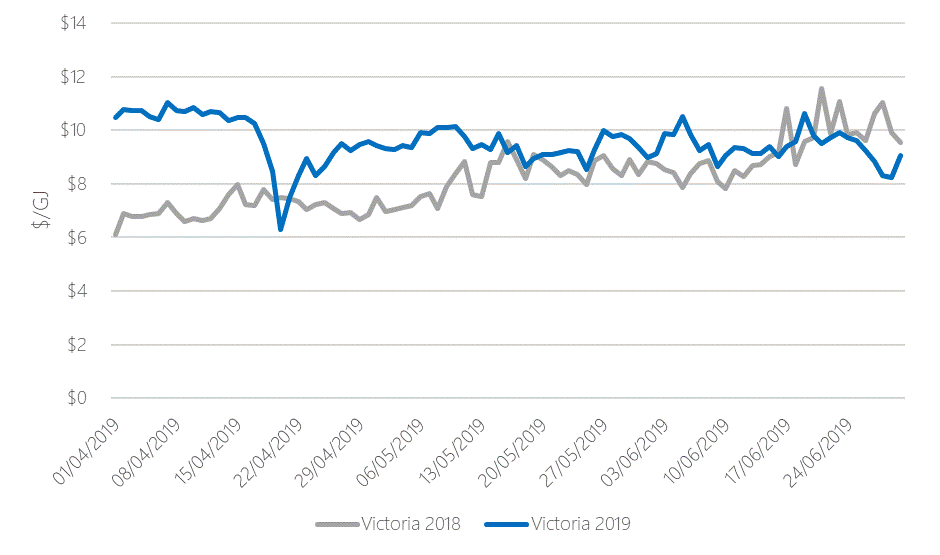

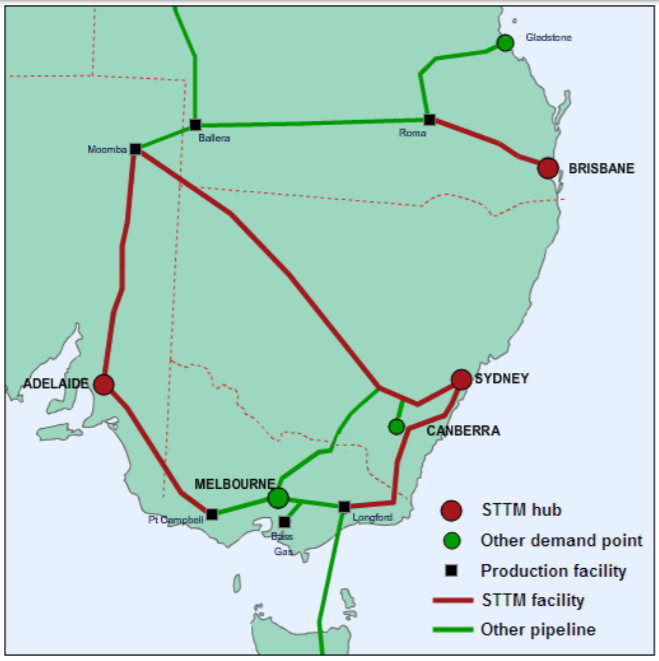

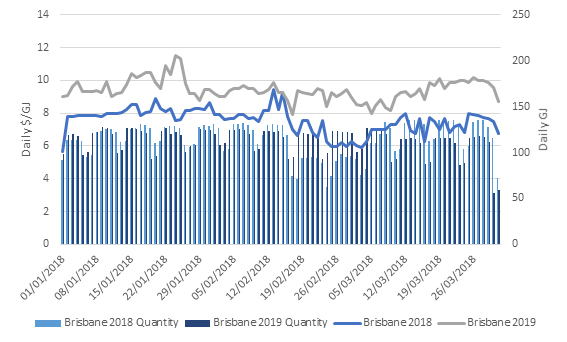

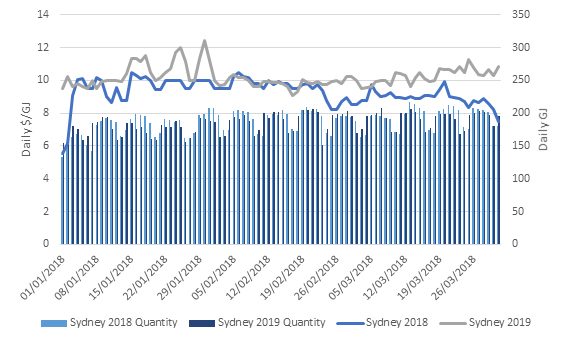

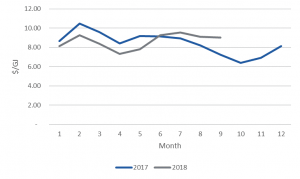

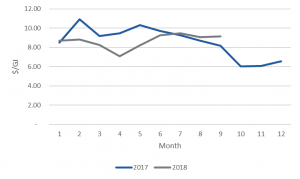

Further impacts of the oil market crash on gas markets has been cheaper domestic gas prices for consumers. Queensland, the largest gas extractor and exporter on the east coast has seen prices in its short-term trading market (STTM) in Brisbane reach as low as AUD$2.31/GJ in March 2020, a significant drop from AUD$9-11/GJ we witnessed the same in 2019. Other energy commodities have also seen a decline off the back of the oil price tumble, including thermal coal. As stated above, with gas prices domestically and internationally falling away, thermal coal prices have come off due to energy users opting for cheaper fuel sources such as oil and gas. Spot thermal coal contracts for the May 2020 settled at USD$52.35/metric ton(mt) on 30/04/2020, far softer than spot prices a year ago at ~USD$90/mt.

This brings us to the all-important energy market and commodity, electricity, which with all the above combined has seen electricity prices fall off a cliff. The National Electricity Market (NEM) in the last few years has been on a renewable power growth spurt. Queensland for instance has the highest penetration of large scale solar generation of approximately ~2,400 MW and a significant penetration of rooftop solar reaching ~2,100 MW, combine them together and on a mild April day in 2020, you have almost 2 thirds of maximum demand. With renewable energy displacing thermal/fossil fuels, off the back of reducing pricing for the technology and subsidies in the form of renewable energy certificates (RECs), combined with both far cheaper gas prices allowing gas plant to bid in and capture price spikes due to their fast-start and intermittent operating capabilities, and reduced demand for electricity due to the impact of COVID-19 with business and industry operating skeletally, electricity prices continue to sit at prices not witnessed since 2016.

All the above has been caused by two events, both significant to the global economy, and the energy industry in their own rights. One thing is for sure, the events have helped push the electricity market on the East Coast of Australia into a new direction far quicker than it may have if the two COVID-19 and the oil price crash did not occur. We are seeing new market design concepts (ie. capacity markets, two-sided markets) and new contract market products (ie. super-peak swap) coming to light, that give way to new technologies and greater competition. The abundance of natural gas in Australia is affordable for households for heating and is finally being utilised as the ‘transition’ or bridging fuel it was always pegged as, to renewable energy in the wholesale market. One thing is for certain, change is afoot, and it definitely has me excited.

If you have any questions regarding this article or the electricity market in general, call Edge on 07 3905 9220 or 1800 334 336.