With expectations that CleanCo will be trading in the NEM by mid this year, things are getting into full swing. Last week CleanCo appointed its first two key executives – Miles George and Geoff Dutaillis.

Who are these new executives?

Miles George has been appointed the Interim Chief Executive Officer (CEO) at CleanCo. His role at CleanCo is to secure cleaner, more affordable, sustainable energy and secure supply of electricity for Queensland (QLD). He was previously the CEO and Managing Director of Infigen Energy. After leaving Infigen Energy in 2016, Miles continued as a strategic adviser until December 2017. During and after his time at Infigen, Miles has been the Chairman of the Clean Energy Council, a representative on the AEMC Reliability panel, an Expert panel member for AEMO and Director of the Australian Conservation Foundation.

Geoff Dutaillis has been appointed the General Manager of Transition. Geoff was most recently the CEO (Australia) of Wind Energy Holdings, a leading renewable energy company based in Thailand. The company has interest in various Australian wind farms. Geoff has also held executive positions at Infigen Energy as Chief Operating Officer (COO) from 2009 until 2013 and Lendlease more recently as Head of Sustainability.

What is the mandate for CleanCo?

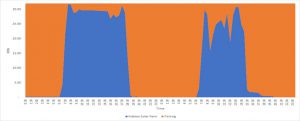

CleanCo has the mandate to increase competition in the electricity market at peak times of demand when prices are generally at their highest. CleanCo is expected to transform intermittent renewable generation into firm financial products for customers and retailers while backing QLD’s renewable energy and low emissions generators.

Which of the existing generators are to be transferred from the current government owned corporations; Stanwell and CS Energy?

Initially, CleanCo’s portfolio will include a range of existing renewable and low emission energy generation assets including:

- Wivenhoe pump storage hydro plant,

- Swanbank E gas-fired power station, and

- Barron Gorge, Kareeya and Koombooloomba hydro power stations.

If you have any questions regarding CleanCo or any other matter relating to energy, please contact Edge Energy Services on 07 3905 9220 or 1800 334 336.