In the energy market, probably not unlike most complex markets / industries, we never let the truth stand in the way of a good mainstream news story. So much so, at Edge we struggle to watch mainstream news!

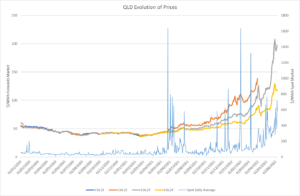

Yesterday Edge highlighted that a tight supply balance was not the key driver for the unprecedented high prices occurring in the spot and contract markets.

As previously outlined, generators bidding behaviour is playing a pivotal role, lifting the average price in the spot market as their spot traders shift volume into higher price bands. This pushed spot prices so high that on Sunday the market reached the cumulative price threshold (CPT). This means that the sum of spot prices in a seven-day period hit a level which caused AEMO to intervene and cap prices until the market returns below this threshold.

As has been widely discussed on Sunday evening, AEMO stepped in and controlled the spot price once the sum of the previous 2,016 (7 days) trading intervals equalled the cumulative total of $1,359,000. The cumulative CPT is equivalent to an average price of $674.16/MWh for the seven-day period.

During market intervention, spot prices in the relevant region are capped at $300/MWh. This commenced at 6.55pm on Sunday night in Queensland and will continue until the 7-day average drops below the CPT. Once this is achieved the CPT remains on foot until at least 04:00 the next trading day.

Since Queensland hit the cap on Sunday, we have now seen every mainland region in the National Electricity Market (NEM) also hit the CPT. As at publication, intervention pricing is currently enacted in all of these regions (QLD, NSW, VIC, and SA). Tasmania is currently under threat also.

During market intervention the maximum spot price can only reach $300/MWh (there is also a floor of -$300/MWh). $300/MWh is currently lower than the short run marginal cost (SRMC) of many gas generators when priced against the current gas price, which is also currently capped by AEMO (at $40/GJ).

A consequence of capping these markets is higher priced generation withdraws from the electricity market, as an example gas generator have a Short Run Marginal Cost (SRMC) of generation of roughly $400/MWh based on a fuel cost of $40/GJ, but with a cap of $300/MWh on the electricity generated it results in generators removing their availability from the market which in turn results in regional availability dropping. Hence subsequent threats of power outages and the potential requirement for load shedding. It’s a case of the market being more under threat from commercial drivers than physical drivers.

The commercial dynamics of the current market create a perceived lack of availability in the market and leads to generators looking to other (non-capped) revenue streams for their generation stack. This is precisely what occurred over Monday with 607MW of availability being removed from QLD available generation, and 930MW removed from NSW. The drop in dispatchable generation resulted in AEMO publishing a Lack of Reserve (LOR) forecast and requests by AEMO for a market response. Rather than this call being answered, generators held firm and did not place generation back into the traditional bid stacks. Across Monday the LOR dropped further as more generation disappeared into the ancillary market and as we approached the evening peak AEMO called an LOR3, which resulted in AEMO also calling on Reliability and Emergency Reserve Trader (RERT) providers to fill the availability gap.

Overnight AEMO’s action on calling RERT prevented load shedding, however this may not be the case in NSW tonight where 590MW of load is forecast to be interrupted at 19:00. If there is insufficient support under RERT to compensate for this supply shortage, we could see load shedding.

With all mainland NEM regions currently operating under the CPT we expect to see more market intervention, and those generators exposed to a capped gas price removing volume out of the market as electricity prices are capped at levels below their SRMC. This is likely to see AEMO needing to intervene in other regions, invoking RERT to source additional availability, or failing that load shedding.

Article by Alex Driscoll and Stacey Vacher.