Written by Alex Driscoll, Senior Manager – Markets, Trading, and Advisory

In recent weeks we have seen a rapid increase in the cost of electricity both in Queensland (“QLD”) and New South Wales (“NSW”).

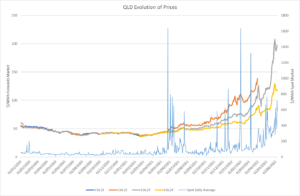

The chart shows how spot prices (light blue line) and forward prices in QLD have increased considerably since mid-2021. Most notably, we’ve seen frightening increases since mid May 2022.

The question is, what is really driving these unprecedented high prices?

The question is, what is really driving these unprecedented high prices?

Underlying fuel costs are playing their role, as we’ve seen significant increases in the cost of gas and coal resulting from the Ukraine crisis. Recent weather conditions on the east coast of Australia have also adversely impacted coal deliveries.

Analysis of the supply / demand balance and the bidding behaviour of participants is also in focus. Whilst underlying fuel prices have had a part to play, trading behaviour appears to be playing a leading role in the most recent electricity price increases. At a high level, the structure of the bid stack is a key driver to volatility occurring in QLD and NSW over the past few weeks.

Having analysed the market Edge2020 have found that small changes in the supply / demand balance coupled with strategic bidding behaviour has had a significant impact on spot prices. Edge2020’s analysis shows that as solar generation diminishes the market power and influence on the spot price shifts from intermittent generation such as solar, to thermal generators such as gas-fired and coal fired generation. With surplus availability of generation across the states, high demand or scarcity of supply are not the key drivers for the higher prices.

Both QLD and NSW bid stacks reflect the recent strategic bidding of generators in these regions. The bid stacks show how peaking plant are dispatching units at elevated prices, well above levels supported by inflated gas prices. Bid stacks also indicate that coal fired generation is not operating at full capacity. In the absence of news to the contrary, we can assume that output has been restricted for commercial reasons rather than technical limitations. Noting that no re-bids with technical limitations were published during the period analysed.

As spot market volatility has increased, as to have prices across the forward market, with uncertainty and risk having been priced in significantly. Views on future fundamentals remain broad, resulting in differing strategies between forward traders. Whilst spot traders successfully maintain unprecedented volatility in spot prices however, it’s difficult for forward traders to sell into this market. Once the opportunity presents to do so, we could see significant spreads and chunky declines in forward pricing.