The electricity market was active throughout autumn and the transition into winter. Spot prices were largely stable as has been the case ever since the Queensland Government directed Stanwell Corporation to adopt strategies to lower wholesale prices and Snowy Hydro Corporation seem to be willing to draw down their dam levels to keep prices in New South Wales below $300.00/MWh for each trading period.

Stable spot prices doesn’t mean that the market has been uneventful. In Queensland utility scale solar is expected to grow from only having Barcaldine Solar Farm (25 MW capacity) to more than 2,000 MW installed by the end of 2019. In November 2017 Kidston Solar Farm (50 MW capacity) started generating and since April 2018 we have seen the addition of Sun Metals, Clare, and Longreach solar farms with a combined capacity of 248 MW. Other solar farms are being commissioned at the moment including Hamilton, Whitsunday and Hughenden which means that Queensland will soon have 453 MW of utility scale solar. This is in addition to the small scale solar installed already in Queensland which is more than 2,000 MW and continuing to grow.

New South Wales continue to struggle with sufficient capacity.

To date Snowy Hydro has increased its output when prices looked like it was going to go above $300.00/MWh. This strategy has appeared to be successful with only two prices above this level ($300.80/MWh and $301.06/MWh on 25 July 2017 at 18:00 and 18:30 respectively) since the start of 2017. This defence of prices has come at a large cost to the dam levels with the main dam, Lake Eucumbene, dropping below 30% full which is the lowest level since 2011. In early June 2018, constraints prevented much of Snowy Hydro’s portfolio from being dispatched and the New South Wales prices spiked to $2,428.77/MWh and $2,447.89/MWh on 5 June at 17:30 and 18:30 respectively. The high prices followed large cloud cover reducing generation from solar farms and the removal of several large coal plant due to planned or unplanned outages. These outages persisted and there was another price spike on 7 June 2018 at 19:00 where prices in New South Wales reached $2,464.52/MWh. On both days where the prices were high, AEMO had warned that there were insufficient reserve of generation and Tomago Smelter had demand curtailed under their agreement with AGL.

Victoria was comparatively quiet during autumn. Spot prices remain high in a historical context with the period from 1 April to 30 June averaging $94.92/MWh – more than $10.00/MWh higher than New South Wales over the same period.

Victoria use to enjoy an abundance of cheap generation from their brown coal generators however have seen more imports from South Australia and New South Wales since the closure of Hazelwood Power Station. Victoria has an old fleet of highly polluting power stations and need an orderly transition to avoid suffering intermittent issues seen in South Australia.

Tasmania continues to manage their dam levels to avoid the constraints on local manufacturing plant which was experienced during the last extended outage on Basslink. There was trouble on the interconnector again with no flow between 24 March 2018 and 5 June 2018 following an accident during maintenance. The highly specialised nature of the underseas cable means that parts take a long time to procure and then be installed. Overall the state managed to supply electricity throughout the period. The reliability of Basslink is a further cause for concern as Tasmania is trying to become the “battery of the nation” by using its abundant pumped storage hydro sites to effectively store energy while there is excess renewable generation and produce electricity when there is less renewable generation being produced. If the electricity cannot be reliably transferred in and out of Tasmania, the investment decision is less attractive.

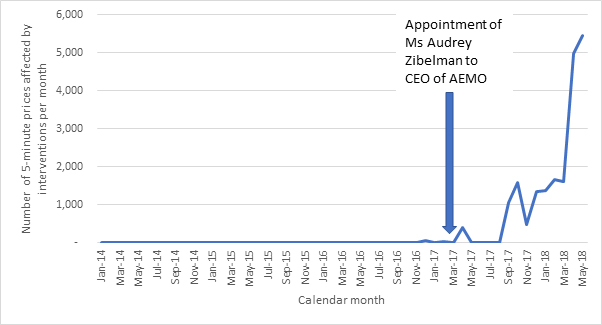

South Australia had more price periods affected by market intervention during May 2018 than any other time in the past.

More than half (61%) of the time, the prices were affected by directions from AEMO.

Some of this is due to Pelican Point coming off 23 April 2018 and not returning until 23 May 2018. An intervention price occurs when AEMO has directed a participant (typically a generator) to dispatch in a different way to its bidding. This was typically used to direct a gas or diesel power station to operate through periods where the owner expected it to not be commercially viable to operate. This was done to strengthen the grid by securing sufficient synchronous generation remains online at all times. AEMO then calculates how the market would have settled if they hadn’t issued the direction. This calculation doesn’t take into account the fact that bidding may have been different if the direction hadn’t been issued. Participants could have chosen to turn on voluntarily or wait for higher prices. As such, this will distort the pricing signal provided in the market. Even though spot prices tend to be lower during these directions, participants that are directed are entitled to compensation which is ultimately paid for by the consumers. When the price signal is taken out of the spot market and put directly onto retailers (who pass the costs on), there is little incentive to solve the issue. The total amount of interventions have increased dramatically as the system is getting weaker however it also seems to be part of a new direction from AEMO. To put the number of interventions into context, there were roughly 20 times more intervention periods in May 2018 (5,451) than the 10 years prior (228) to the appointment of the CEO Audrey Zibelman.

If the intervention continues, the spot prices will remain lower however the cost to the consumers could increase.

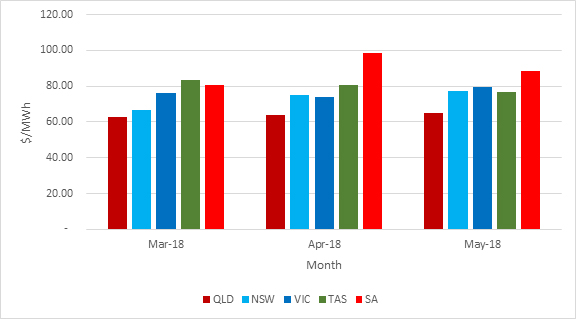

Overall spot prices were lower than the summer period with the cheapest spot prices being in the North and the East. Queensland had the cheapest prices followed by New South Wales and Victoria. Tasmania managed to end the period with lower prices than South Australia despite Basslink being cut off for part of the period.

The more stable spot conditions saw the forward prices decrease across all the traded regions. The largest fall was in Victoria where prices reduced $8.97/MWh for calendar year 2019 contracts. New South Wales also reduced $8.43/MWh as spot prices remained stable. The forward prices are now similar across Victoria, New South Wales and Queensland however South Australia continues to trade higher than the other regions. This is in part due to expectations that the spot prices are likely to stay higher than elsewhere and partly as firm contracts are more difficult to get as many renewable generators are unable to offer firm prices. Recently Snowy Hydro has been acquiring power purchase agreements with renewable generators and released a tender for up to 800 MW of additional renewable generation. It is likely that Snowy Hydro will use its pump storage hydro plant to firm up the renewable generation offering more firm contracts.

Table 1: Calendar year 2019 forward contracts

| NSW | QLD | SA | VIC | |

| 1 March 2018 | 76.58 | 64.05 | 94.36 | 82.9 |

| 31 May 2018 | 68.15 | 62.64 | 87.00 | 73.93 |

If you would like to discuss the electricity market outlook and potential impact to your electricity portfolio, please contact our Manager of Markets & Advisory, Thomas Dargue on 07 3905 9226 or on 1800 EDGE ENERGY.