As we move out of Q2 2022, a quarter that we have never seen behave in this way before, it is interesting to see how things have changed in Q3 to date.

Why was Q2 2022 so controversial? Well, we saw record spot prices, record forward prices, caps put on the gas market, caps put in place in the electricity market, market direction, the activation of Reliability and Emergency Reserve Trader (RERT) and eventually suspension of the National Electricity Market (NEM). As we moved through Q3 has the situation changed?

To make this decision we must first review Q2, to assist us in understanding if things are going to change. What caused all the market intervention in Q2 and the eventual market suspension?

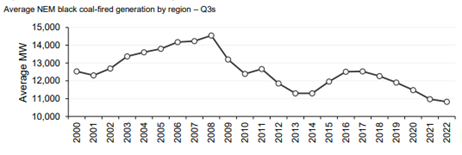

Q2 is normally a quiet time in the NEM, demand is low, and generators take the opportunity to take units offline for routine planned overhauls. The drop in availability that results from the units on overhaul are normally soaked up by the remaining units online. This Q2 we saw a lower than normal number of units online across the NEM to take up this slack, namely Callide C4 that was offline due to the catastrophic failure in May 2021, Swanbank E and thermal generators dispatching less volume due to flooding across NSW and QLD reducing coal supplies.

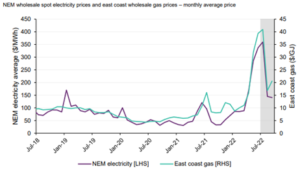

Q2 2022 saw average spot prices more than double compared with recent years and peaked at the end of the quarter. The average for Q2 2022 reached $332/MWh in Qld, $302/MWh in NSW, SA at $257/MWh and VIC the lowest, at $224/MWh.

Interestingly the quarterly average price for NSW and QLD was above where the Administered Price Cap (APC). The APC is triggered when the sum of the previous 7 days trading intervals equals $1,359,100. The price is then capped at $300/MWh and remains in place at least until the end of the trading day.

Q2 2022 was a quarter of extreme price, low availability, and market interventions. In Queensland for example we saw 42 hours of spot prices below $0/MWh but also 32 hours above $1,000/MWh. While we did not see a significant number of prices reaching the market cap of $15,100/MWh we did see solid prices that increased the average to levels not normally seen in Q2.

During Q2, exacerbating the issue, we saw significant volume bid in below $0/MWh so units would remain online, however with little between this price and higher prices meant there was a visible gap in the bid stack until prices were over $300/MWh. This distribution was a result of higher fuel cost such as spot gas at $40/GJ which converts to a generation price of over $400/MWh. However, we also saw the emergence of strategic bidding that introduced volatility and higher average prices into the market. The result of the strategic bidding was spot prices for the majority of the time across the NEM were above $100/MWh and often above $300/MWh.

As coal supplies became limited due to flooding, the gas price also jumped due to the global supply issues caused by the war in Ukraine. These fundamentals led to the spot prices increasing and eventually forcing the market operator to cap the market when the Administered Price Cap was reached. APC put a cap of $300/MWh on the electricity spot market.

As a result of the APC, generators removed capacity out of the market rather than operating at a loss due to their higher spot fuel cost. This resulted in the removal of over 3,000MW of generation in which forced AEMO to intervene in the market and direct units online as well as being forced to activate RERT to maintain system security.

Over a few days operating under the APC the market became impractical to operate using directions and AEMO eventually suspended the market on 15 June 2022.

During market suspension AEMO took over the control of the dispatch of market participants units.

Simultaneously during the market suspension, availability returned to the market as units returned from overhauls, coal and gas supply restriction improved and trading strategies were reviewed by the market participants.

On 24 June 2022 AEMO lifted the suspension of the market and the NEM returned to normal operation.

Since the lifting of the market suspension and the commencement of Q3 we have seen a change in some behavior, however spot prices remain high. In the first week of Q3 market participants took advantage of market conditions of low intermittent generation ensuring they benefitted from the ability to increase volatility. In the first week spot price hit the new maximum price cap of $15,500/MWh on several occasions.

While these price spike has lifted the quarterly average for the first 21 days of Q3 to $466/MWh in QLD and $418/MWh in NSW we are seeing this average drop each day.

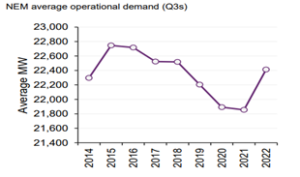

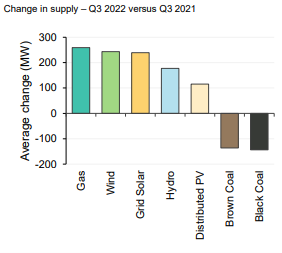

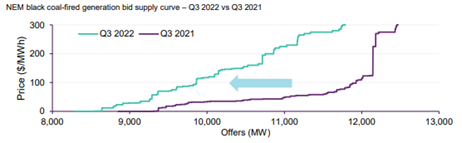

The main driver for the lower spot prices is, as mentioned before, the improved availability across the NEM. Availability in QLD is regularly reaching 9,000MW compared to in June when it dropped 6,600MW. The short-term outlook for generation continues to improve daily with the majority of planned outages now completed.

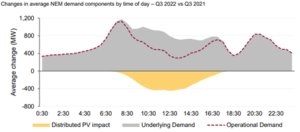

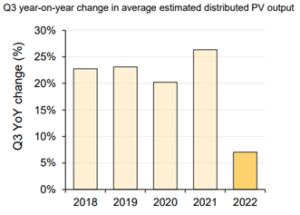

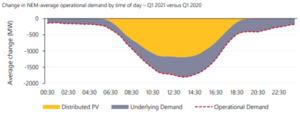

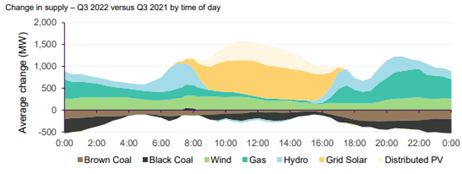

A secondary driver that has pushed down average prices is the return of the sun. Solar generation is now regularly pushing the spot price below $100/MWh and on some occasions back into negative territory.

Less volatility in the spot market has been reflected in the forward market with Q422 QLD dropping from over $270/MWh in June to $260/MWh and the Q123 product dropping below $250/MWh.

Without delving into the gas supply concerns in Victoria, all other states have removed the price cap on gas allowing the market to operate more efficiently. This has not resulted in the gas market trading at significantly high prices as feared, Qld is $42.75/GJ, NSW is $51.51/GJ and SA at $45.51, translating into a sub $500/MWh peaking gas plant cost of generation.

As the weather warms up and the daylight hours increase, we expect to see a drop in demand, with heating loads reducing coupled with an increase in the generation provided by solar.

All of this, as well as increased thermal generator availability and stability in the gas markets, should see spot and forward prices continue to fall across the quarter.